Travelers 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.underwriting risks of business in natural catastrophe-prone areas and target risk areas for conventional

terrorist attacks (defined as attacks other than nuclear, biological, chemical or radiological events). The

Company relies, in part, upon these analyses to make underwriting decisions designed to manage its

exposure on catastrophe-exposed business. For example, as a result of these analyses, the Company has

limited the writing of new property and homeowners business in some markets and has selectively

taken underwriting actions on new and existing business. These underwriting actions on new and

existing business include tightened underwriting standards, selective price increases and changes to

deductibles specific to hurricane-, tornado-, wind- and hail-prone areas. See ‘‘Item 7—Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Catastrophe Modeling’’ and

‘‘—Changing Climate Conditions.’’ The Company also utilizes reinsurance to manage its aggregate

exposures to catastrophes. See ‘‘—Reinsurance.’’

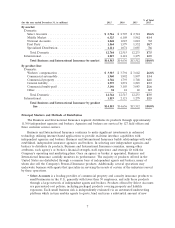

BUSINESS AND INTERNATIONAL INSURANCE

The Business and International Insurance segment offers a broad array of property and casualty

insurance and insurance related services to its clients, primarily in the United States and in Canada, as

well as in the United Kingdom, the Republic of Ireland, Brazil and throughout other parts of the world

as a corporate member of Lloyd’s. Business and International Insurance is organized as follows:

Domestic

•Select Accounts provides small businesses with property and casualty products, including

commercial multi-peril, commercial property, general liability, commercial auto and workers’

compensation insurance.

•Middle Market provides mid-sized businesses with property and casualty products, including

commercial multi-peril, commercial property, general liability, commercial auto and workers’

compensation insurance, as well as risk management, claims handling and other services. Middle

Market generally provides these products to mid-sized businesses through Commercial Accounts,

as well as to targeted industries through Construction, Technology, Public Sector Services and

Oil & Gas. Middle Market also provides mono-line umbrella and excess coverage insurance

through Excess Casualty and insurance coverages for foreign organizations with United States

exposures through Global Partner Services.

•National Accounts provides large companies with casualty products and services, including

workers’ compensation, general liability and automobile liability, generally utilizing loss-sensitive

products, on both a bundled and unbundled basis. National Accounts also includes the

Company’s commercial residual market business, which primarily offers workers’ compensation

products and services to the involuntary market.

•First Party provides traditional and customized property insurance programs to large and mid-

sized customers through National Property, insurance for goods in transit and movable objects, as

well as builders’ risk insurance, through Inland Marine, insurance for the marine transportation

industry and related services, as well as other businesses involved in international trade, through

Ocean Marine, and comprehensive breakdown coverages for equipment, including property and

business interruption coverages, through Boiler & Machinery.

•Specialized Distribution markets and underwrites its products to customers predominantly through

brokers, wholesale agents, program managers and specialized retail agents that manage

customers’ unique insurance requirements. Specialized Distribution provides insurance coverage

for the commercial transportation industry, as well as commercial liability and commercial

property policies for small, difficult to place specialty classes of commercial business primarily on

an excess and surplus lines basis, through Northland, and tailored property and casualty

programs on an admitted basis for customers with common risk characteristics or coverage

5