Travelers 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

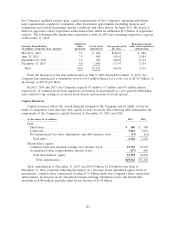

The following table provides a reconciliation of total capitalization excluding net unrealized gains

on investments to total capitalization presented in the foregoing table.

(at December 31, dollars in millions) 2015 2014

Total capitalization excluding net unrealized gains on investments ............. $28,653 $29,219

Net unrealized gain on investments, net of taxes .......................... 1,289 1,966

Total capitalization .............................................. $29,942 $31,185

Debt-to-total capital ratio ......................................... 21.2% 20.4%

Debt-to-total capital ratio excluding net unrealized gains on investments ....... 22.1% 21.7%

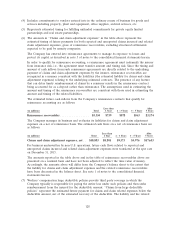

The debt-to-total capital ratio excluding net unrealized gain on investments is calculated by

dividing (a) debt by (b) total capitalization excluding net unrealized gains and losses on investments,

net of taxes. Net unrealized gains and losses on investments can be significantly impacted by both

interest rate movements and other economic factors. Accordingly, in the opinion of the Company’s

management, the debt-to-total capital ratio calculated on this basis provides another useful metric for

investors to understand the Company’s financial leverage position. The Company’s ratio of debt-to-total

capital (excluding after-tax net unrealized investment gains) of 22.1% at December 31, 2015 was within

the Company’s target range of 15% to 25%.

Credit Agreement. The Company is a party to a five-year, $1.0 billion revolving credit agreement

with a syndicate of financial institutions that expires in June 2018. Terms of the credit agreement are

discussed in more detail in note 8 of notes to the consolidated financial statements herein.

Shelf Registration. The Company has filed with the Securities and Exchange Commission a

universal shelf registration statement for the potential offering and sale of securities. The Company

may offer these securities from time to time at prices and on other terms to be determined at the time

of offering.

Share Repurchase Authorization. At December 31, 2015, the Company had $3.33 billion of

capacity remaining under its share repurchase authorization approved by the board of directors.

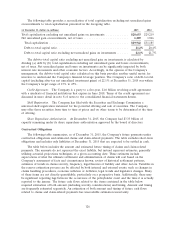

Contractual Obligations

The following table summarizes, as of December 31, 2015, the Company’s future payments under

contractual obligations and estimated claims and claim-related payments. The table excludes short-term

obligations and includes only liabilities at December 31, 2015 that are expected to be settled in cash.

The table below includes the amount and estimated future timing of claims and claim-related

payments. The amounts do not represent the exact liability, but instead represent estimates, generally

utilizing actuarial projections techniques, at a given accounting date. These estimates include

expectations of what the ultimate settlement and administration of claims will cost based on the

Company’s assessment of facts and circumstances known, review of historical settlement patterns,

estimates of trends in claims severity, frequency, legal theories of liability and other factors. Variables in

the reserve estimation process can be affected by both internal and external events, such as changes in

claims handling procedures, economic inflation or deflation, legal trends and legislative changes. Many

of these items are not directly quantifiable, particularly on a prospective basis. Additionally, there may

be significant reporting lags between the occurrence of the policyholder event and the time it is actually

reported to the insurer. The future cash flows related to the items contained in the table below

required estimation of both amount (including severity considerations) and timing. Amount and timing

are frequently estimated separately. An estimation of both amount and timing of future cash flows

related to claims and claim-related payments has unavoidable estimation uncertainty.

126