Travelers 2015 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At Lloyd’s, International competes with other syndicates operating in the Lloyd’s market as well as

international and domestic insurers in the various markets where the Lloyd’s operation writes business

worldwide. Competition is again based on price, product and service. The Company focuses on lines it

believes it can underwrite effectively and profitably with an emphasis on short-tail insurance lines.

BOND & SPECIALTY INSURANCE

The Bond & Specialty Insurance segment provides surety, fidelity, management liability,

professional liability, and other property and casualty coverages and related risk management services

to a wide range of primarily domestic customers, utilizing various degrees of financially-based

underwriting approaches. The range of coverages includes performance, payment and commercial

surety and fidelity bonds for construction and general commercial enterprises; management liability

coverages including directors and officers liability, employee dishonesty, employment practices liability,

fiduciary liability and cyber risk for public corporations, private companies and not-for-profit

organizations; professional liability coverage for a variety of professionals including, among others,

lawyers and design professionals; and management liability, professional liability, property, workers’

compensation, auto and general liability for financial institutions.

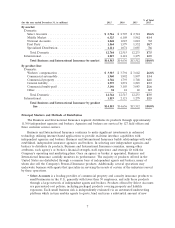

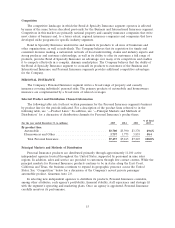

Selected Market and Product Information

The following table sets forth Bond & Specialty Insurance net written premiums by product line

for the periods indicated. For a description of the product lines referred to in the table, see ‘‘Principal

Markets and Methods of Distribution’’ and ‘‘Product Lines,’’ respectively.

% of Total

(for the year ended December 31, in millions) 2015 2014 2013 2015

Fidelity and surety ................................... $ 952 $ 963 $ 918 45.7%

General liability .................................... 952 961 934 45.7

Other ............................................ 177 179 178 8.6

Total Bond & Specialty Insurance ...................... $2,081 $2,103 $2,030 100.0%

Principal Markets and Methods of Distribution

Bond & Specialty Insurance distributes the vast majority of its products in the United States

through approximately 5,900 of the same independent agencies and brokers that distribute the Business

and International Insurance segment’s products in the U.S. The Bond & Specialty Insurance segment,

in conjunction with the Business and International Insurance segment, continues to make investments

in enhanced technology utilizing internet-based applications to provide real-time interface capabilities

with its independent agencies and brokers. Bond & Specialty Insurance builds relationships with well-

established, independent insurance agencies and brokers. In selecting new independent agencies and

brokers to distribute its products, Bond & Specialty Insurance considers, among other attributes, each

agency’s or broker’s profitability, financial stability, staff experience and strategic fit with its operating

and marketing plans. Once an agency or broker is appointed, its ongoing performance is closely

monitored.

Pricing and Underwriting

Bond & Specialty Insurance utilizes underwriting, claims, engineering, actuarial and product

development disciplines for specific accounts and industries, in conjunction with extensive amounts of

proprietary data gathered and analyzed over many years, to facilitate its risk selection process and

develop pricing parameters. The Company utilizes both standard industry forms and proprietary forms

for the insurance policies it issues.

13