Travelers 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287

|

|

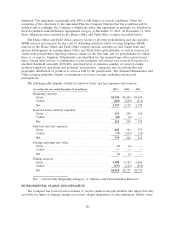

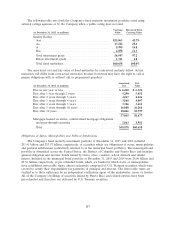

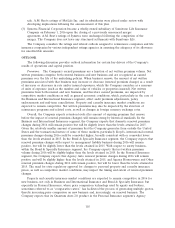

The following table shows the geographic distribution of the $25.35 billion of municipal bonds at

December 31, 2015 that were not pre-refunded.

State Local Total Average

General General Carrying Credit

(at December 31, 2015, in millions) Obligation Obligation Revenue Value Quality(1)

State:

Texas ................................ $ 139 $ 2,519 $1,077 $ 3,735 Aaa/Aa1

Virginia .............................. 120 789 914 1,823 Aaa/Aa1

Washington ........................... 119 1,029 568 1,716 Aa1

California ............................ 41 790 458 1,289 Aa1

Minnesota ............................ 151 871 98 1,120 Aaa/Aa1

North Carolina ......................... 78 660 297 1,035 Aaa/Aa1

Massachusetts ......................... 45 45 858 948 Aaa/Aa1

Maryland ............................. 129 535 204 868 Aaa/Aa1

Illinois ............................... 49 525 259 833 Aa1

Colorado ............................. — 567 233 800 Aa1

Georgia .............................. 133 475 144 752 Aaa/Aa1

Arizona .............................. — 410 329 739 Aa1

Wisconsin ............................ 175 297 243 715 Aa1

South Carolina ......................... 36 476 166 678 Aa1

New Jersey ........................... — 266 375 641 Aaa

Oregon .............................. 189 225 220 634 Aa1

All others(2)(3) ........................ 669 2,839 3,517 7,025 Aaa/Aa1

Total .............................. $2,073 $13,318 $9,960 $25,351 Aaa/Aa1

(1) Rated using external rating agencies or by the Company when a public rating does not exist.

Ratings shown are the higher of the rating of the underlying issuer or the insurer in the case of

securities enhanced by third-party insurance for the payment of principal and interest in the event

of issuer default.

(2) No other single state accounted for 2.5% or more of the total non-pre-refunded municipal bonds.

(3) The Company does not own any municipal securities issued by the city of Detroit, MI.

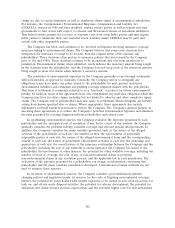

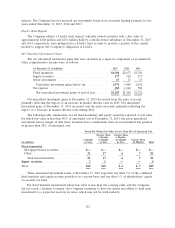

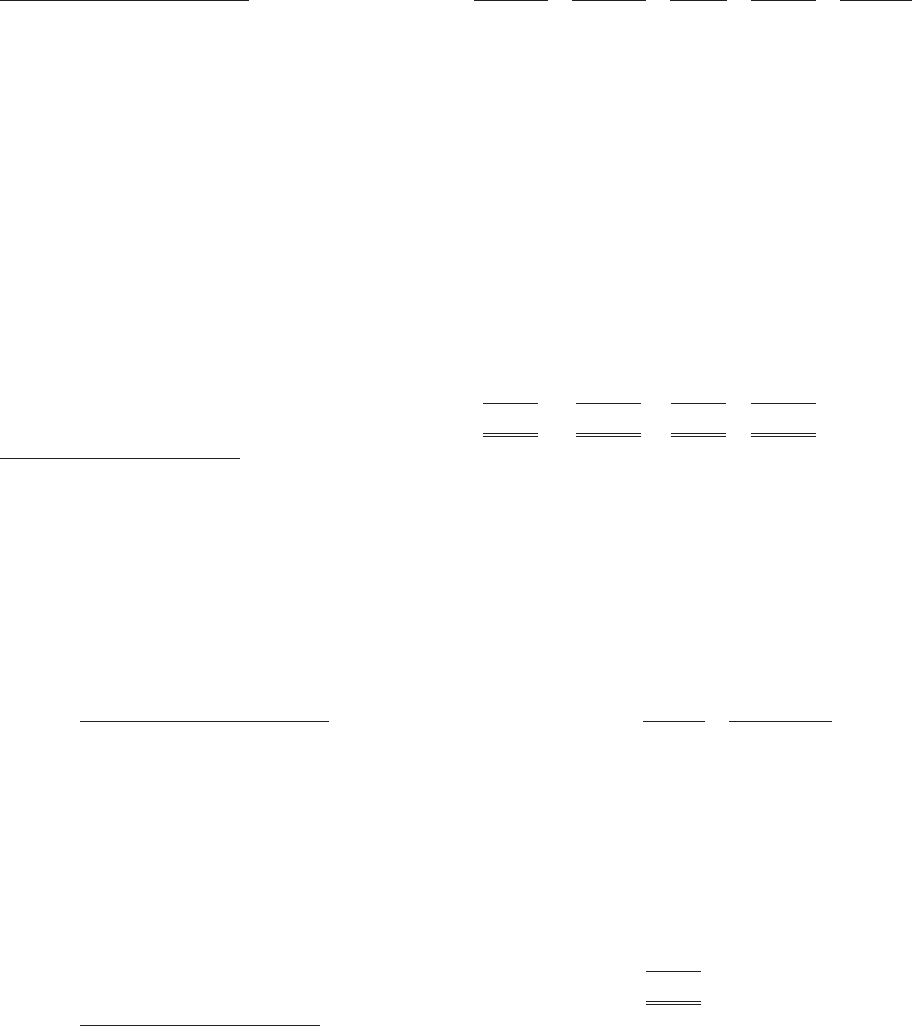

The following table displays the funding sources for the $9.96 billion of municipal bonds identified

as revenue bonds in the foregoing table at December 31, 2015.

Carrying Average Credit

(at December 31, 2015, in millions) Value Quality(1)

Source:

Water and sewer ............................... $3,722 Aaa/Aa1

Higher education .............................. 2,370 Aaa/Aa1

Power and utilities ............................. 1,001 Aa2

Transportation ................................ 928 Aa1

Special tax ................................... 670 Aa1

Lease ....................................... 115 Aa3

Housing ..................................... 101 Aaa/Aa1

Healthcare ................................... 39 Aa2

Property tax .................................. 12 Aa2

Other revenue sources ........................... 1,002 Aaa/Aa1

Total ...................................... $9,960 Aaa/Aa1

(1) Rated using external rating agencies or by the Company when a public rating does not

exist. Ratings shown are the higher of the rating of the underlying issuer or the insurer in

the case of securities enhanced by third-party insurance for the payment of principal and

interest in the event of issuer default.

108