Travelers 2015 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Automobile line of business will continue to increase new business premiums during 2016 compared

with the levels attained in 2015, although at a lower rate of increase than in recent periods. The

Company also expects that, as a result of strong business retentions and increases in new business,

policies in force in the Personal Insurance segment’s Agency Automobile line of business will continue

to increase during 2016 compared with the number of policies in force at December 31, 2015. Policies

in force in the Personal Insurance segment’s Homeowners and Other line of business are also expected

to increase in 2016 compared with the number of policies in force at December 31, 2015. In each of

the Company’s business segments, new business generally has less of an impact on underwriting

profitability than renewal business, given the volume of new business relative to renewal business.

However, in periods of meaningful increases in new business, despite its positive impact on

underwriting gains over time, the impact of a higher mix of new business versus renewal business may

negatively impact the combined ratio in the short-term.

General uncertainty regarding a variety of domestic and international matters, such as the U.S.

Federal budget and taxes, implementation of the Affordable Care Act, the regulatory environment,

geopolitical instability, slow growth and economic uncertainty in the United States and in various parts

of the world, rapid changes in commodity prices, such as in oil, and fluctuations in interest rates and

foreign currency exchange rates has added to the uncertainty regarding economic conditions generally.

If economic conditions deteriorate, the resulting low levels of economic activity could impact exposure

changes at renewal and the Company’s ability to write business at acceptable rates. Additionally, low

levels of economic activity could adversely impact audit premium adjustments, policy endorsements and

mid-term cancellations after policies are written. All of the foregoing, in turn, could adversely impact

net written premiums in 2016, and because earned premiums are a function of net written premiums,

earned premiums could be adversely impacted on a lagging basis.

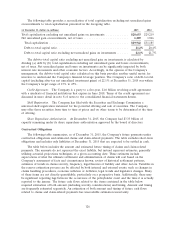

Underwriting Gain/Loss. The Company’s underwriting gain/loss can be significantly impacted by

catastrophe losses and net favorable or unfavorable prior year reserve development, as well as

underlying underwriting margins.

Catastrophe and other weather-related losses are inherently unpredictable from period to period.

The Company experienced significant catastrophe and other weather-related losses in a number of

periods during the past decade, which adversely impacted its results of operations. The Company’s

results of operations could be adversely impacted if significant catastrophe and other weather-related

losses were to occur.

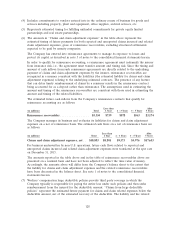

For the last several years, the Company’s results have included significant amounts of net favorable

prior year reserve development driven by better than expected loss experience in all of the Company’s

segments. However, given the inherent uncertainty in estimating claims and claim adjustment expense

reserves, loss experience could develop such that the Company recognizes higher or lower levels of

favorable prior year reserve development, no favorable prior year reserve development or unfavorable

prior year reserve development in future periods. In addition, the ongoing review of prior year claims

and claim adjustment expense reserves, or other changes in current period circumstances, may result in

the Company revising current year loss estimates upward or downward in future periods of the current

year.

It is possible that the steps taken by the federal government in recent years, particularly by the

Federal Reserve, to stabilize financial markets and improve economic conditions could lead to higher

inflation than the Company had anticipated, which could in turn lead to an increase in the Company’s

loss costs and the need to strengthen claims and claim adjustment expense reserves. These impacts of

inflation on loss costs and claims and claim adjustment expense reserves could be more pronounced for

those lines of business that are considered ‘‘long tail’’, such as general liability, as they require a

relatively long period of time to finalize and settle claims for a given accident year. For a further

discussion, see ‘‘Part I—Item 1A—Risk Factors—If actual claims exceed our claims and claim

119