Travelers 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287

|

|

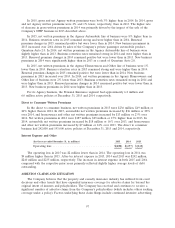

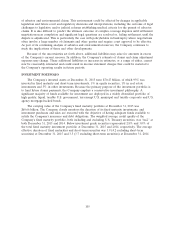

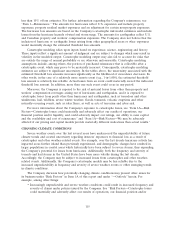

The following table sets forth the Company’s fixed maturity investment portfolio rated using

external ratings agencies or by the Company when a public rating does not exist:

Carrying Percent of Total

(at December 31, 2015, in millions) Value Carrying Value

Quality Rating:

Aaa ....................................... $25,865 42.7%

Aa ........................................ 17,226 28.4

A......................................... 8,998 14.8

Baa ....................................... 6,858 11.3

Total investment grade .......................... 58,947 97.2

Below investment grade ......................... 1,711 2.8

Total fixed maturities ........................... $60,658 100.0%

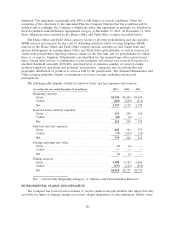

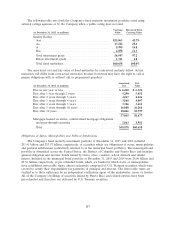

The amortized cost and fair value of fixed maturities by contractual maturity follow. Actual

maturities will differ from contractual maturities because borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

Amortized Fair

(at December 31, 2015, in millions) Cost Value

Due in one year or less .............................. $ 6,240 $ 6,324

Due after 1 year through 2 years ....................... 5,290 5,452

Due after 2 years through 3 years ...................... 4,267 4,426

Due after 3 years through 4 years ...................... 3,868 4,007

Due after 4 years through 5 years ...................... 3,316 3,411

Due after 5 years through 10 years ...................... 16,008 16,260

Due after 10 years .................................. 18,026 18,797

57,015 58,677

Mortgage-backed securities, collateralized mortgage obligations

and pass-through securities .......................... 1,863 1,981

Total .......................................... $58,878 $60,658

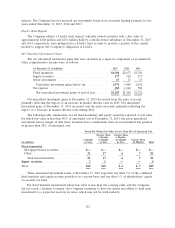

Obligations of States, Municipalities and Political Subdivisions

The Company’s fixed maturity investment portfolio at December 31, 2015 and 2014 included

$31.41 billion and $33.57 billion, respectively, of securities which are obligations of states, municipalities

and political subdivisions (collectively referred to as the municipal bond portfolio). The municipal bond

portfolio is diversified across the United States, the District of Columbia and Puerto Rico and includes

general obligation and revenue bonds issued by states, cities, counties, school districts and similar

issuers. Included in the municipal bond portfolio at December 31, 2015 and 2014 were $6.06 billion and

$7.56 billion, respectively, of pre-refunded bonds, which are bonds for which states or municipalities

have established irrevocable trusts, almost exclusively comprised of U.S. Treasury securities, which were

created to satisfy their responsibility for payments of principal and interest. The irrevocable trusts are

verified as to their sufficiency by an independent verification agent of the underwriter, issuer or trustee.

All of the Company’s holdings of securities issued by Puerto Rico and related entities have been

pre-refunded and therefore are defeased by U.S. Treasury securities.

107