Symantec 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

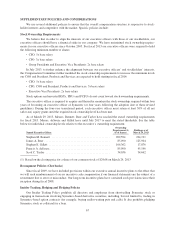

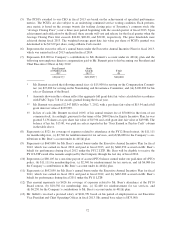

(14) Represents two one-time sign-on bonuses designed to partially offset Mr. Gillett’s forfeiture of various

bonuses, including $2,552,000 of previously-paid bonuses that he was obligated to repay in full, as a result

of his departure from his former employer. Mr. Gillett is obligated to repay all or a portion of these sign-on

bonuses if he voluntarily leaves the Company or is terminated for cause prior to December 21, 2017.

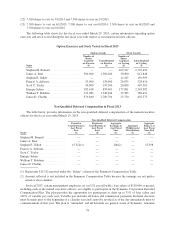

(15) Represents the following non-employee director compensation paid to Mr. Gillett prior to his becoming our

Executive Vice President and Chief Operating Officer in December 2012:

Fees Earned

or Paid in Cash

($)*

Stock

Awards

($)†**

Total

($)

20,013†† 249,987†† 270,000

* Mr. Gillett received an annual fee of $20,000 for serving on the Audit Committee.

†Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance

with FASC Topic 718 for awards granted during the fiscal year.

** Mr. Gillett was granted 12,547 RSUs on May 7, 2012, with a per share fair value of $15.94 and a full

grant date fair value of $199,999.

†† In lieu of cash, Mr. Gillett received 100% of his annual retainer fee of $50,000 in the form of our common

stock. Accordingly, pursuant to the terms of the 2000 Director Equity Incentive Plan, he was granted 3,136

shares at a per share fair value of $15.94 and a full grant date fair value of $49,988. The balance of his fee,

$13.00, was paid in cash as reported in the “Fees Earned or Paid in Cash” column in the table above.

(16) Mr. deSouza’s base salary increased from $435,000 to $700,000 in January 2013 in connection with his

appointment as our President, Products and Services as we transitioned to our new organizational structure.

Accordingly, this amount reflects payments based on his original base salary of $435,000 for the first nine

months of fiscal 2013 and his adjusted salary for the remainder of fiscal 2013.

(17) Represents (a) $3,201 for reimbursement for tax services, and (b) $7,539 for the Company’s contributions

to Mr. deSouza’s account under its 401(k) plan.

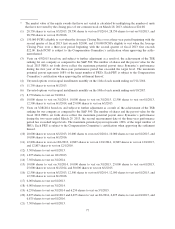

(18) Represents (a) $348,000 for Mr. deSouza’s annual bonus under the Executive Annual Incentive Plan for

fiscal 2012, which was earned in fiscal 2012 and paid in fiscal 2013, and (b) $446,250 for Mr. deSouza’s

performance during fiscal 2012 under the FY12 LTIP. Mr. deSouza will be eligible to receive the FY12

LTIP award if he remains employed by the Company through the last day of fiscal 2014.

(19) Represents (a) $53,538 for PTO payout, (b) $2,521 for reimbursement for tax services, and (c) $6,763 for

the Company’s contributions to Mr. deSouza’s account under its 401(k) plan.

(20) Represents (a) $959 for coverage of expenses related to attendance at the FY12 Board retreat, (b) $1,111 for

membership fees, (c) $6,529 for reimbursement for tax services, and (d) $6,000 for the Company’s con-

tributions to Mr. Taylor’s account under its 401(k) plan.

(21) Represents salary paid through the effective date of Mr. Salem’s resignation, July 24, 2012.

(22) Represents payouts of $933,333 under the FY12 LTIP and $2,411,111 under the FY11 LTIP pursuant to the terms.

(23) Represents severance pay pursuant to Mr. Salem’s Employment Agreement. See “Potential Payments Upon

Termination or Change in Control” below.

(24) Represents (a) $1,110,000 for Mr. Salem’s annual bonus under the Executive Annual Incentive Plan for

fiscal 2012, which was earned in fiscal 2012 and paid in fiscal 2013, and (b) $2,100,000 accrued on

Mr. Salem’s behalf for performance during fiscal 2012 under the FY12 LTIP. Mr. Salem received a pro-

rated amount of the FY12 LTIP award based on the terms of the FY12 LTIP.

(25) Represents PTO payout for Mr. Salem.

(26) Represents (a) $1,181,250 for Mr. Salem’s annual bonus under the Executive Annual Incentive Plan for

fiscal 2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $3,100,000 accrued on

Mr. Salem’s behalf for performance during fiscal 2011 under the FY11 LTIP. Mr. Salem received a pro-

rated amount of the FY11 LTIP award based on the terms of the FY11 LTIP.

73