Symantec 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.‰We do not provide for gross-ups of excise tax values under Section 4999 of the Internal Revenue Code.

‰We limit any potential severance payments to well under 3x our executive officers’ total target cash

compensation.

‰We have clawback provisions in all of our executive compensation plans (providing for the return of any

excess compensation received by an executive officer if our financial statements are the subject of a

restatement due to error or misconduct).

‰Our executive officers are prohibited from short-selling Symantec stock or engaging in transactions involv-

ing Symantec-based derivative securities, and are also prohibited from pledging their Symantec stock.

‰Our equity incentive plan prohibits the repricing or exchange of equity awards without stockholder appro-

val.

‰We seek stockholder feedback on our executive compensation through an annual advisory vote and

ongoing stockholder engagement.

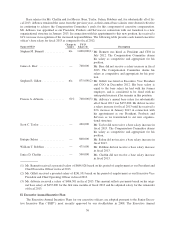

Summary of Compensation Matters During Fiscal 2013

Business Changes and Performance in Fiscal 2013

Our company experienced significant changes during fiscal year 2013. Stephen Bennett was appointed as

our President and Chief Executive Officer of our company in July 2012. In January 2013, we announced a new

strategy to provide improved, long-term performance for Symantec and thereby deliver increased value to our

employees, customers, partners and stockholders. Core to the strategy is delivering better point products and

higher-value integrated solutions to our customers, thereby helping to solve their need to protect their

information. We have also committed to delivering organic revenue growth of at least 5% and non-GAAP

operating margins of more than 30% over the next few years.

In connection with our implementation of this strategy, we have undertaken a significant organizational

simplification initiative to reduce management layers and redundancies, increase the speed of decision making

and to improve accountability and execution. This initiative has resulted in significant changes to our senior

executive leadership team, including the addition of Stephen Gillett as our new Executive Vice President and

Chief Operating Officer, and the departures of William Robbins, our former Executive Vice President of World-

wide Sales and Services, and Janice Chaffin, our former Group President, Consumer Business Unit. We are also

recruiting world-class talent from some of the most recognized technology companies to strengthen our leader-

ship team. We believe that our new and improved organizational structure will enhance our performance and

increase stockholder value.

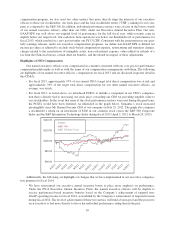

Additionally, in January 2013 we strengthened our commitment to return excess capital to our stockholders

by announcing a program of paying quarterly cash dividends and paid our first quarterly cash dividend of $0.15

per share of our common stock to our stockholders in June 2013. We also spent $826 million to repurchase

49 million shares, reducing our common stock outstanding by 7%, or a net 3.7% after adjusting for the issuance

of employee stock compensation, during fiscal 2013.

In fiscal 2013, Symantec delivered 3% year-over-year growth in revenue (5% adjusting for currency) and

1% growth in deferred revenue (3% adjusting for currency) driven by strength in our backup business, Software-

as-a Service (SaaS), data loss prevention, and managed security services offerings. Our cash flow from oper-

ations decreased 16% compared to fiscal 2012 while our cash and cash equivalents (including short-term

investments) grew 48% year-over-year. Our non-GAAP net income increased by 5% and non-GAAP diluted

earnings per share increased 10% year over year.

Financial and Compensation Metrics

As detailed below, during fiscal 2013, we used three core financial metrics, which we believe are strongly

correlated to enterprise value for companies in our sector, to measure company performance under our executive

compensation programs: revenue, non-GAAP earnings per share (“EPS”) and cash flow from operations. For a

significant portion of the long-term equity incentive compensation component of our regular annual executive

48