Symantec 2013 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

may be issued related to the warrants using the treasury stock method. For the first $1.00 by which the average

price exceeds $27.3175 per share, there would be a dilutive effect from both the 1.00% notes and the warrants

totaling approximately 18.8 million shares. As the share price continues to increase, additional dilution would

occur but at a declining rate. See Note 13 for information regarding the dilutive effect on EPS.

In periods prior to conversion, the note hedge transactions are not considered for purposes of the EPS

calculation, as their effect would be anti-dilutive. Upon conversion, the note hedge will automatically serve to

neutralize the dilutive effect of the 1.00% notes when the stock price is above $19.12 per share. For example, if

upon conversion the price of our common stock was $28.3175 per share, the cumulative effect of approximately

18.8 million shares in the example above would be reduced to approximately 1.8 million shares. The preceding

calculations assume that the average price of our common stock exceeds the respective conversion prices during

the period for which dilutive EPS is calculated and excludes any potential adjustments to the conversion ratio

provided under the terms of the 1.00% notes.

In the period of conversion, the 1.00% notes will have no impact on diluted EPS if the notes are settled in

cash and will have an impact on dilutive EPS if the notes are settled in shares upon conversion.

Revolving credit facility

In the first quarter of fiscal 2013, we amended our credit facility agreement. The amendment extended the

term of the credit facility to June 7, 2017 and revolving loans under the credit facility will bear interest, at our

option, either at a rate equal to a) LIBOR plus a margin based on debt ratings, as defined in the credit facility

agreement or b) the bank’s base rate plus a margin based on debt ratings, as defined in the credit facility

agreement. Under the terms of this credit facility, we must comply with certain financial and non-financial

covenants, including a covenant to maintain a specified ratio of debt to EBITDA (earnings before interest, taxes,

depreciation and amortization). As of March 29, 2013, we were in compliance with all financial covenants, and

no amounts were outstanding.

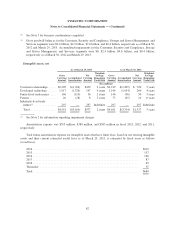

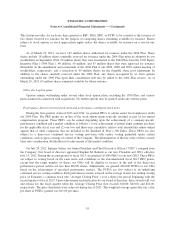

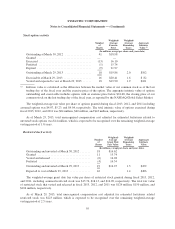

Note 7. Restructuring and Transition

Our restructuring and transition costs and liabilities consist primarily of severance, facilities costs, and

transition and other related costs. Severance generally includes severance payments, outplacement services,

health insurance coverage, and legal costs. Facilities costs generally include rent expense and lease termination

costs, less estimated sublease income. Transition and other related costs primarily consist of severance costs

associated with acquisition integrations in efforts to streamline our business operations, and consulting charges

associated with the planning and design phase of a new enterprise resource planning system. Restructuring and

transition costs are included in the Other segment.

Restructuring plan

In the fourth quarter of fiscal 2013, the Company announced its strategic direction to streamline and

simplify the Company in order to deliver significantly improved performance to customers and partners. The

Company intends to focus on key strategic customer offerings and simplify our Go-To-Market strategy and

organizational structure. In order to deliver on this focus, the Company initiated a restructuring plan to reduce the

layers of management and redundant personnel resulting in headcount reductions across the Company. These

actions are expected to be completed in fiscal 2014. As of March 29, 2013, total cost incurred to date is $10

million, primarily related to severance and benefits. We expect to incur total severance and benefit costs between

$220 million and $250 million.

86