Symantec 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

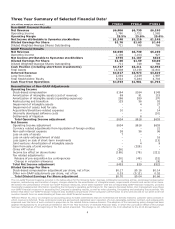

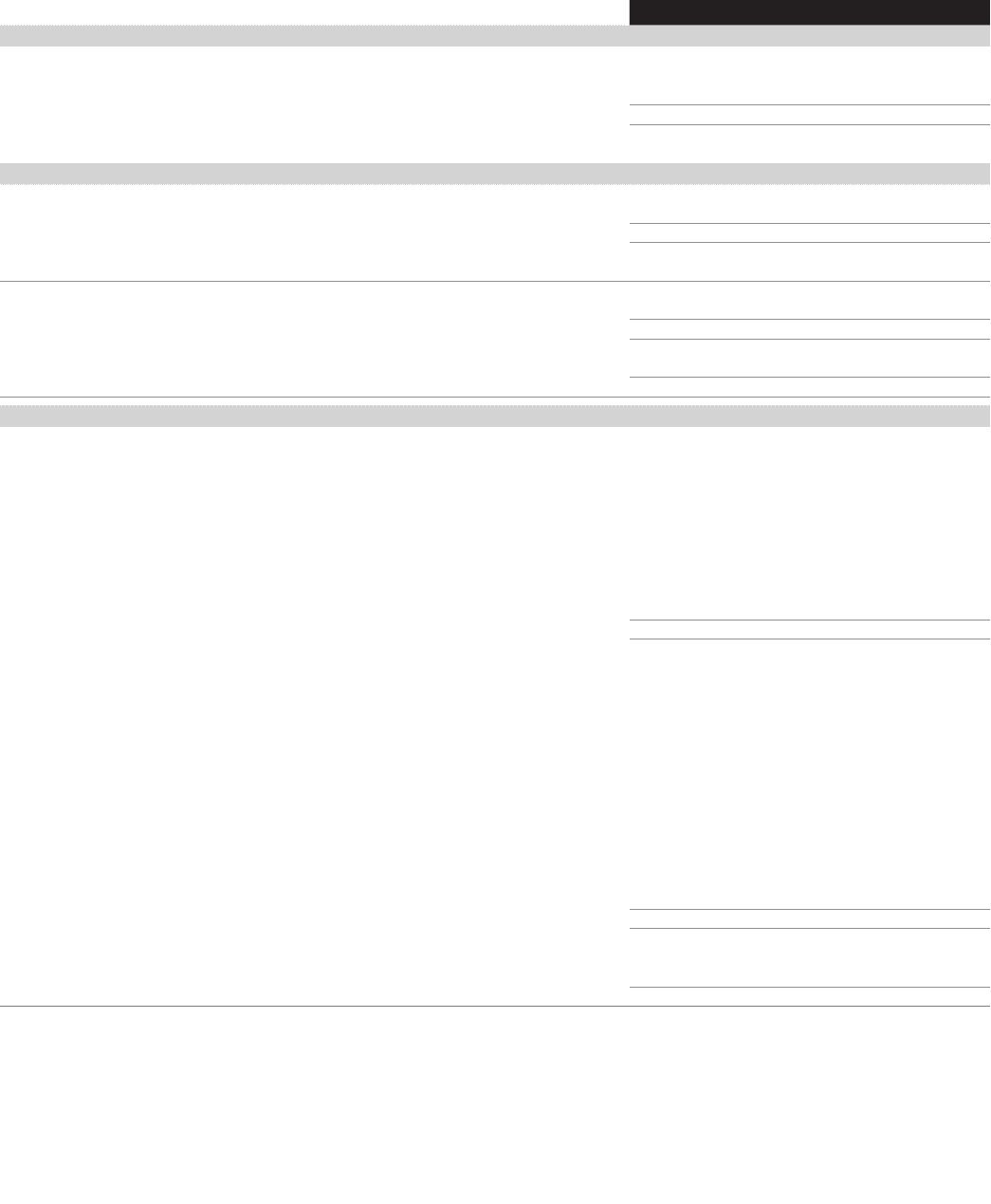

Three Year Summary of Selected Financial Data1

($ in millions, except per share data) FY2013 FY2012 FY2011

Non-GAAP Financial Results

Net Revenue $6,906 $6,730 $6,190

Operating Income 1,760 1,722 1,582

Operating Margin 25.5% 25.6% 25.6%

Net Income attributable to Symantec stockholders $1,248 $1,216 $1,148

Diluted Earnings Per Share $1.76 $1.63 $1.46

Diluted Weighted-Average Shares Outstanding 711 748 786

GAAP Financial Results

Net Revenue $6,906 $6,730 $6,190

Operating Income 1,106 1,104 927

Net Income attributable to Symantec stockholders $755 $1,187 $626

Diluted Earnings Per Share $1.06 $1.59 $0.80

Diluted Weighted-Average Shares Outstanding 711 748 786

Cash Position (including short-term investments) $4,747 $3,211 $2,958

Total Assets 14,508 13,158 12,841

Deferred Revenue $4,017 $3,973 $3,819

Long-Term Debt 2,094 2,039 1,987

Total Stockholders’ Equity 5,522 5,284 4,703

Cash Flow from Operations $1,593 $1,901 $1,794

Reconciliation of Non-GAAP Adjustments

Operating Income

Stock-based compensation $164 $164 $145

Amortization of intangible assets (cost of revenue) 69 91 115

Amortization of intangible assets (operating expenses) 286 289 270

Restructuring and transition 125 56 92

Impairment of intangible assets - 4 27

Impairment of assets held for sale - - 2

Acquisition/divestiture-related expenses 10 6 14

Internally developed software costs - - (10)

Settlements of litigation - 8 -

Total Operating Income adjustment $654 $618 $655

Net Income

Operating Income adjustment $654 $618 $655

Currency related adjustments from liquidation of foreign entities - - 21

Non-cash interest expense 58 56 96

Loss on sale of assets 7 - -

Loss on early extinguishment of debt - - 16

Loss (gain) on sale of short-term investments - 1 (13)

Joint venture: Amortization of intangible assets - 4 9

Gain from sale of joint venture - (526) -

China VAT refund (26) - -

Income tax effect on above items (186) (76) (221)

Tax related adjustments:

Release of pre-acquisition tax contingencies (20) (48) (32)

Change in valuation allowance 6 - (9)

Total Net Income adjustment $493 $29 $522

Diluted Earnings Per Share

Stock-based compensation adjustment per share, net of tax $0.17 $0.16 $0.14

Other non-GAAP adjustments per share, net of tax 0.53 (0.12) 0.52

Total Diluted Earnings Per Share adjustment $0.70 $0.04 $0.66

The non-GAAP nancial measures included in the tables adjust for the following items: business combination accounting entries, stock-based compensation

expense, restructuring and transition charges, charges related to the amortization of intangible assets, impairments of assets and certain other items.

We believe the presentation of these non-GAAP nancial measures, when taken together with the corresponding GAAP nancial measures, provides

meaningful supplemental information regarding the Company’s operating performance for the reasons discussed below. Our management uses these

non-GAAP nancial measures in assessing the Company’s operating results, as well as when planning, forecasting and analyzing future periods. We

believe that these non-GAAP nancial measures also facilitate comparisons of the Company’s performance to prior periods and to our peers and that

investors benet from an understanding of these non-GAAP nancial measures.

1

Effective March 30, 2013, we changed our accounting policy for sales commissions that are incremental and directly related to customer sales contracts in

which revenue is deferred. These commission costs are accrued and capitalized upon execution of a non-cancelable customer contract, and subsequently

expensed over the term of such contract in proportion to the related future revenue streams. The adoption of this accounting policy change has been

applied retrospectively to all periods presented in this Three Year Summary of Selected Financial Data, in which the cumulative effect of the change

has been reected as of the beginning of the rst period presented. This change is not reected in the 10-K attached to the 2013 Annual Report.