Symantec 2013 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

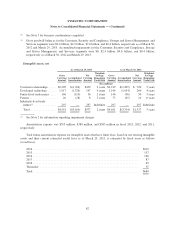

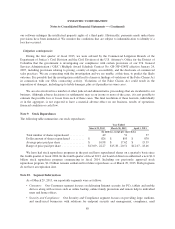

Note 5. Supplemental Financial Information

Accumulated other comprehensive income

As of

March 29,

2013

March 30,

2012

(In millions)

Foreign currency translation adjustments, net of (tax benefits) taxes of

$(6) million and $16 million as of March 29, 2013 and March 30, 2012,

respectively ................................................... $181 $174

Unrealized gain on available-for-sale securities, net of taxes of $11 million

and $0 million as of March 29, 2013 and March 30, 2012, respectively .... 16 1

Accumulated other comprehensive income .......................... $197 $175

Less: Accumulated other comprehensive income attributable to noncontrolling

interest ....................................................... — 2

Accumulated other comprehensive income attributable to Symantec

Corporation ............................................... $197 $173

Gain from sale of joint venture

In fiscal 2008, Symantec formed a joint venture with a subsidiary of Huawei Technologies Co., Limited

(“Huawei”). On March 30, 2012, we sold our 49% ownership interest in the joint venture to Huawei for

$530 million in cash. The gain of $530 million, offset by costs to sell the joint venture of $4 million, was

included in Gain from sale of joint venture in our Consolidated Statements of Income.

Other income (expense), net

In fiscal 2013, we began receiving a tax incentive from the China tax bureau in the form of value-added tax

(“VAT”) refunds. The tax incentive is provided to companies that perform software research and development

activities in China. The refunds relate to VAT collected on qualifying software product sales. This tax incentive

plan enables companies to retrospectively apply the rules back to January 2011. As of March 29, 2013, we

recognized cumulative refunds of $33 million, which were included in Other income (expense), net in our

Consolidated Statements of Income.

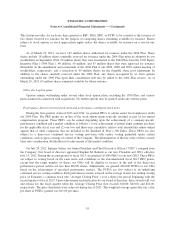

Note 6. Debt

The following table summarizes components of our debt:

As of March 29, 2013

Face Value

Effective

Interest Rate Fair Value(2)

(In millions)

3.95% Senior Notes, due June 2022 (“3.95% notes”) ...... $ 400 4.05% $ 412

2.75% Senior Notes, due June 2017 (“2.75% notes due

2017”) ......................................... 600 2.79% 620

4.20% Senior Notes, due September 2020 (“4.20%

notes”) ......................................... 750 4.25% 799

2.75% Senior Notes, due September 2015 (“2.75% notes

due 2015”) ...................................... 350 2.76% 363

1.00% Convertible Senior Notes, due June 2013

(“1.00% notes”) .................................. 1,000 6.78%(1) 1,291

83