Symantec 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A Total Rewards Approach: Elements of the total rewards offered to our executive officers include base

salary, short- and long-term incentives including equity awards, health benefits, a deferred compensation pro-

gram and a consistent focus on individual professional growth and opportunities for new challenges.

Appropriate Market Positioning: Our general pay positioning strategy is to target the levels of base

salary, annual short-term cash incentive structure and long-term incentive opportunities and benefits for our

named executive officers with reference to the relevant market data for each position. The Compensation Com-

mittee may set the actual components for an individual named executive officer above or below the positioning

benchmark based on factors such as experience, performance achieved, specific skills or competencies, the

desired pay mix (e.g., emphasizing short- or long-term results), and our budget.

For fiscal 2013, we generally targeted the pay positioning for our executive officers at the 50th percentile of

the relevant market composite for salary, and continued to gradually shift our target for the variable pay elements

from the 50th percentile to the 65th percentile, subject to individual and company performance.

Competitive Market Assessments: Market competitiveness is one factor that the Compensation Commit-

tee considers each year in determining a named executive officer’s overall compensation package, including pay

mix. The Compensation Committee relies on various data sources to evaluate the market competitiveness of each

pay element, including publicly-disclosed data from a peer group of companies (see discussion below) and pub-

lished survey data from a broader set of information technology companies that the Compensation Committee,

based on the advice of Mercer, believes represent Symantec’s competition in the broader talent market. The peer

group’s proxy statements provide detailed pay data for the top five positions. Survey data, which we obtain from

the Radford Global Technology Survey, Radford Global Sales Survey and Kenexa IPAS Global High Technol-

ogy survey, provides compensation information on a broader group of executives and from a broader group of

information technology companies, with positions matched based on specific job scope and responsibilities. The

Compensation Committee considers data from these sources as a framework for making compensation decisions

for each named executive officer’s position.

The information technology industry in which we compete is characterized by rapid rates of change and

intense competition from small and large companies, and the companies within this industry have significant

cross-over in leadership talent needs. As such, we compete for executive talent with leading software and serv-

ices companies as well as in the broad information technology industry. We particularly face intense competition

with companies located in the geographic areas where Symantec operates, regardless of specific industry focus or

company size. Further, because we believe that stockholders measure our performance against a wide array of

technology peers, the Compensation Committee uses a peer group that consists of a broader group of high tech-

nology companies in different market segments that are of a comparable size to us. The Compensation Commit-

tee uses this peer group, as well as other relevant market data, to evaluate named executive officer pay levels (as

described above).

The Compensation Committee reviews our peer group on an annual basis, with input from Mercer, and the

group may be adjusted from time to time based on, among other inputs, a comparison of revenues, market

capitalization, industry and peer group performance. The Compensation Committee used the below peer group in

setting the compensation for our named executive officers, other than our current CEO and Mr. Gillett, at the

beginning of fiscal 2013. For our current CEO, the Compensation Committee adjusted the below peer group by

eliminating Apple and Oracle from its analysis in an effort to limit skewing of the data due to the higher CEO

compensation levels.

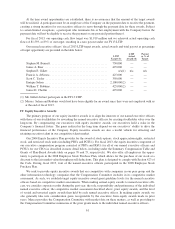

Fiscal 2013 Symantec Peer Group

Adobe Systems Incorporated Electronic Arts Inc. NetApp, Inc.

Analog Devices, Inc. EMC Corporation Oracle Corporation

Apple Inc. Harris Corporation Qualcomm Incorporated

CA, Inc. Juniper Networks, Inc. Seagate Technology Plc

Cisco Systems, Inc. Lexmark International, Inc. Yahoo! Inc.

Based in part on feedback obtained from a majority of our top 100 investors and their advisers, as well as

input from Mercer, and after taking into consideration what is appropriate for our company, stockholders and

52