Symantec 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

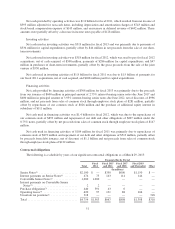

Foreign currency exchange rate risk

We conduct business in 32 currencies through our worldwide operations and, as such, we are exposed to

foreign currency risk. Foreign currency risks are associated with our cash and cash equivalents, investments,

receivables, and payables denominated in foreign currencies. Our exposure to foreign currency transaction gains

and losses is the result of certain net receivables due from our foreign subsidiaries and customers being

denominated in currencies other than the functional currency of the subsidiary, primarily the Euro and Singapore

dollar. Our foreign subsidiaries conduct their businesses in local currency. We have entered into foreign

exchange forward contracts with up to six months in duration, to offset the foreign exchange risk on certain

monetary assets and liabilities denominated in currencies other than the local currency of the subsidiary. We

considered the historical trends in currency exchange rates and determined that it was reasonably possible that

adverse changes in exchange rates for all currencies could be experienced. The estimated impacts of a five or ten

percent appreciation or depreciation in value are as follows:

Value of

Contracts

Given X%

Appreciation of

Foreign

Currency Notional

Amount

Value of

Contracts

Given X%

Depreciation of

Foreign

Currency

Foreign Forward Exchange Contracts 10% 5% (5)% (10)%

(In millions)

Purchased, March 29, 2013 ........................ $321 $309 $295 $279 $262

Sold, March 29, 2013 ............................ $334 $349 $367 $386 $408

We do not use derivative financial instruments for speculative trading purposes, nor do we hedge our

foreign currency exposure in a manner that entirely offsets the effects of the changes in foreign exchange rates.

Equity price risk

In June 2006, we issued $1.0 billion principal amount of 1.00% notes due June 2013. The 1.00% notes have

a fixed annual interest rate and therefore, we do not have economic interest rate exposure on the convertible

senior notes. However, the fair value will increase as interest rates fall and/or our common stock price increases,

and decrease as interest rates rise and/or our common stock price decreases. The interest and market value

changes affect the fair value of the 1.00% notes, but do not impact our financial position, cash flows, or results of

operations due to the fixed nature of the debt obligations. The carrying value of the 1.00% notes was $997

million as of March 29, 2013 which represents the liability component of the $1.0 billion principal balance. The

total estimated fair value of our 1.00% notes at March 29, 2013 was $1.29 billion and the fair value was

determined based on the closing trading price of $129 per $100 of the 1.00% notes as of that date. See Note 6 of

the Notes to Consolidated Financial Statements in this annual report.

54