Symantec 2013 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

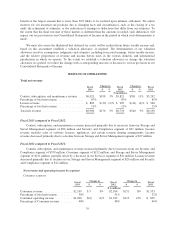

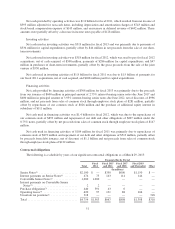

Non-operating income (expense)

Fiscal

2013

Change in Fiscal

2012

Change in Fiscal

2011$ % $ %

($ in millions)

Interest income ............................ $ 12 $ 13 $ 10

Interest expense ........................... (139) (115) (143)

Other income (expense), net .................. 27 (6) (2)

Loss on early extinguishment of debt ........... — — (16)

Loss from joint venture ..................... — (27) (31)

Gain from sale of joint venture ................ — 526 —

Total ................................ $(100) $(491) (126)% $ 391 $573 (315)% $(182)

Percentage of total net revenue ........... (2)% 6% (3)%

Fiscal 2013 compared to Fiscal 2012:

In the first quarter of fiscal 2013, we issued $600 million in principal amount of 2.75% interest-bearing

senior notes due June 2017 and $400 million in principal amount of 3.95% interest-bearing senior notes due June

2022, which resulted in interest expense of $26 million in fiscal 2013. Other income (expense), net increased due

to a tax incentive received from the China tax bureau in the form of value-added tax refunds of $33 million. See

Note 5 of the Notes to Consolidated Financial Statements in this annual report for additional information.

Fiscal 2012 compared to Fiscal 2011:

In fiscal 2012, interest expense decreased due to the repayment of the $1.1 billion convertible senior notes,

which were issued in June 2006. In fiscal 2011, we recorded a loss on early extinguishment of debt of $16

million due to the repurchase of $500 million of aggregate principal amount of the 0.75% notes due on June

2011. See Note 6 of the Notes to Consolidated Financial Statements in this annual report for information on our

debt.

In fiscal 2008, Symantec formed a joint venture with a subsidiary of Huawei Technologies Co., Limited

(“Huawei”). The joint venture was domiciled in Hong Kong with principal operations in Chengdu, China. The

joint venture developed, manufactured, marketed, and supported security and storage appliances on behalf of

global telecommunications carriers and enterprise customers. We recorded a loss of $27 million and $31 million

related to our share of the joint venture’s net loss incurred, for fiscal 2012 and 2011, respectively. We sold our

49% ownership interest in the joint venture to Huawei on March 30, 2012 for a gain of $526 million, which was

included in Gain from sale of joint venture in our Consolidated Statements of Income.

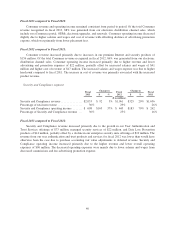

Provision for income taxes

Fiscal 2013 Fiscal 2012 Fiscal 2011

($ in millions)

Provision for income taxes ............................. $258 $298 $105

Effective tax rate on earnings ........................... 25% 20% 15%

Our effective tax rate was approximately 25%, 20%, and 15% in fiscal 2013, 2012, and 2011, respectively.

The tax expense in fiscal 2013 was reduced by the following benefits: (1) $17 million tax benefits arising

from the VERITAS 2002 through 2005 IRS Appeals matters, including adjustments to state liabilities and a

reduction of interest accrued, (2) $13 million in tax benefits resulting from tax settlements and adjustments to

prior year items, (3) $10 million from lapses of statutes of limitation, and (4) $2 million for the benefit of the

46