Symantec 2013 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

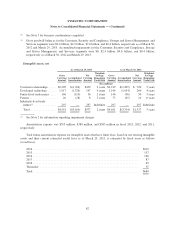

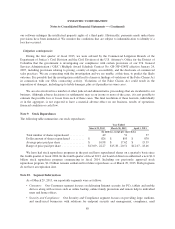

As of March 30, 2012

Face Value

Effective

Interest Rate Fair Value(2)

(In millions)

4.20% Senior Notes, due September 2020 (“4.20%

notes”) ......................................... $ 750 4.25% $ 771

2.75% Senior Notes, due September 2015 (“2.75% notes

due 2015”) ...................................... 350 2.76% 363

1.00% Convertible Senior Notes, due June 2013

(“1.00% notes”) ................................. 1,000 6.78%(1) 1,115

(1) Represents the interest rate on our debt for accounting purposes while taking into account the effects of

amortization of debt discount. Although the effective interest rates of the 1.00% notes were 6.78% for fiscal

2013 and 2012, we are making cash interest payments at the stated coupon rates of 1.00%.

(2) The fair value of debt relies on Level 2 inputs, which is based on market prices for similar debt instruments

and resulting yields. For convertible senior notes, the fair value represents that of the liability component.

See Note 1 for our accounting policy of estimating the fair value of our debt.

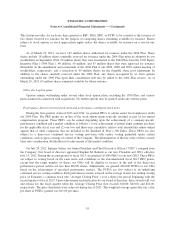

As of March 29, 2013, future maturities of debt by fiscal years are as follows (in millions):

2014 ...................................................................... $1,000

2015 ...................................................................... —

2016 ...................................................................... 350

2017 ...................................................................... —

Thereafter .................................................................. 1,750

Total ...................................................................... $3,100

Senior Notes

In fiscal 2013, we issued the 3.95% notes and 2.75% notes due 2017. These are senior unsecured obligations

that rank equally in right of payment with our future unsecured, unsubordinated obligations and are redeemable

by us at any time, subject to a “make-whole” premium. Our proceeds were $1.0 billion, less issuance discount of

$4 million resulting from sale of the notes at a yield slightly above the stated coupon rate. We also incurred

issuance costs of $6 million. Both the discount and issuance costs are being amortized as incremental interest

expense over the respective terms of the notes. Interest on these notes is payable semiannually. Contractual

interest expense was $26 million in fiscal 2013.

In fiscal 2011, we issued the 4.20% notes and 2.75% notes due 2015. These are senior unsecured obligations

that rank equally in right of payment with our future unsecured, unsubordinated obligations and are redeemable

by us at any time, subject to a “make-whole” premium. Our proceeds from the issuance of the senior notes were

$1.1 billion, net of an issuance discount. Interest on these notes is payable semiannually. Contractual interest

expense was $41 million, $41 million and $22 million in fiscal 2013, 2012, and 2011, respectively.

Convertible Senior Notes

As of March 29, 2013, $1.0 billion of 1.00% notes is included in Current portion of long-term debt in the

Consolidated Balance Sheet. Interest on our convertible senior notes is payable semiannually. Contractual

84