Symantec 2013 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

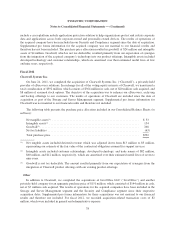

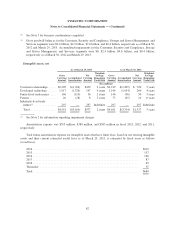

The following table presents the purchase price allocation included in our Consolidated Balance Sheets (in

millions):

LiveOffice Other Total

Acquisition date ............................. January 13, 2012 March 2, 2012

Net tangible (liabilities) assets(1) ................ $ (5) $ 2 $ (3)

Intangible assets(2) ........................... 51 8 59

Goodwill(3) ................................. 69 26 95

Total purchase price .......................... $ 115 $ 36 $151

(1) Net tangible (liabilities) assets included deferred revenue, which was adjusted down from $12 million to $6

million, representing our estimate of the fair value of the contractual obligation assumed for support

services.

(2) Intangible assets included primarily developed technology of $44 million and customer relationships of $15

million, which are amortized over their estimated useful lives of four to ten years. The weighted-average

estimated useful lives were 4.8 years for developed technology and 9.9 years for customer relationships.

(3) Goodwill is partially tax deductible. The goodwill amount resulted primarily from our expectation of

synergies from the integration of the acquisitions’ product offerings with our existing product offerings.

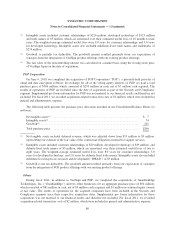

Fiscal 2011

Identity and Authentication Business of VeriSign, Inc.

On August 9, 2010, we completed the acquisition of the identity and authentication business of VeriSign,

Inc. (“VeriSign”), which included a controlling interest in VeriSign Japan K.K. (“VeriSign Japan”) and equity

interests in certain other subsidiary entities. In exchange for the assets and liabilities of the acquired business, we

paid a total purchase price of $1.29 billion, which consisted of $1.16 billion in cash, net of $128 million cash

acquired, and working capital adjustments of $3 million. No equity interests were issued. The results of

operations of VeriSign are included since the date of acquisition as part of the Security and Compliance segment.

Supplemental pro forma information for VeriSign was not material to our financial results and therefore not

included. For fiscal 2011, we recorded acquisition-related transaction costs of $11 million, which were included

in general and administrative expense.

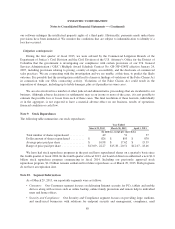

The following table presents the purchase price allocation included in our Consolidated Balance Sheets (in

millions):

Net tangible assets(1) .......................................................... $ 178

Intangible assets(2) ........................................................... 628

Goodwill(3) ................................................................. 602

Net tax liabilities ............................................................ (38)

Noncontrolling interest in VeriSign Japan(4) ....................................... (85)

Total purchase price .......................................................... $1,285

(1) Net tangible assets included deferred revenue, which was adjusted down from $286 million to $68 million,

representing our estimate of the fair value of the contractual obligation assumed for the support of the

authentication business.

79