Symantec 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.if less than 225,000 shares, the full number of unvested shares then remaining) shall vest in addition to any

shares that have previously vested, and any remaining unvested shares subject to the PCSU shall be forfeited, if

the change of control occurs between the beginning of fiscal 2013 and the end of fiscal 2015 and prior to the date

on which all of the shares have vested. In the case of our LTIP, participants will receive an accelerated payout

(either of the amount that had been accrued for the participants (or 100% of target in certain cases) if we experi-

ence a change in control of our company, or if the participant’s employment is terminated without cause after the

applicable performance period has been completed (assuming the threshold performance for such period has been

achieved). See “Potential Payments Upon Termination or Change in Control — Long Term Incentive Plan”

below.

We believe that the double trigger acceleration provision appropriately achieves the intent of the applicable

plan without providing an undue benefit to executives who continue to be employed following a change in con-

trol transaction. The intent of the plan is to enable named executive officers to have a balanced perspective in

making overall business decisions in the context of a potential acquisition of our company, as well as to be

competitive with market practices. The Compensation Committee believes that change in control benefits, if

structured appropriately, serve to minimize the distraction caused by a potential transaction and reduce the risk

that key talent would leave our company before a transaction closes.

Following the end of fiscal 2012, the Compensation Committee conducted an ordinary course review of the

change in control and severance arrangements applicable to our executive officers. Taking into account con-

solidation within our industry and the practices prevalent within our peer group, the Compensation Committee

modified these arrangements in order to improve retention of our senior executives whose roles would likely be

eliminated in connection with a change in control of our company. Specifically, our Executive Retention Plan

was amended to provide for the payment of a cash severance benefit for the named executive officers equal to

one times such officer’s base salary and target payout under the Executive Annual Incentive Plan applicable to

such named executive officer under the same circumstances equity awards would accelerate under the Executive

Retention Plan. In addition, the Compensation Committee adopted the Symantec Corporation Executive Sev-

erance Plan, which provides certain severance benefits to our executive offers, including the named executive

officers, in the event that such executive officers are involuntarily terminated other than for cause (as defined in

the plan). Under the terms of this plan, eligible executive officers are entitled to receive a severance payment

equal to one year of base salary. Payment of the foregoing benefit is subject to the applicable officer returning a

release of claims. The Symantec Corporation Executive Severance Plan replaced the Symantec Corporation

Severance Plan, which provided 10 weeks of base salary for the first year of service plus two weeks of base sal-

ary for every additional year of service. The Compensation Committee determined to modify these arrangements

for the same reason it adopted our Executive Retention Plan.

In connection with his appointment to President and CEO in 2013, we entered into an employment agree-

ment with Stephen Bennett that provides him with certain benefits upon the involuntary termination of his

employment under certain circumstances, including acceleration of vesting and severance payments in con-

nection with a change of control.

The change in control and severance benefits described above do not influence and are not influenced by the

other elements of compensation as these benefits serve different objectives than the other elements. We do not

provide for gross-ups of excise tax values under Section 4999 of the Internal Revenue Code. Rather, we allow the

named executive officer to reduce the benefit received or waive the accelerated vesting of options to avoid excess

payment penalties.

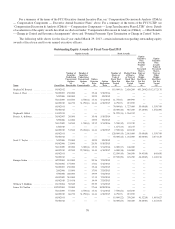

Details of each individual named executive officer’s benefits, including estimates of amounts payable in

specified circumstances in effect as of the end of fiscal 2013, are disclosed under “Potential Payments Upon

Termination or Change in Control” below.

66