Symantec 2013 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Noncontrolling Interest: In July 2012, we completed a tender offer and paid $92 million to acquire VeriSign

Japan common shares and stock rights, which increased our ownership percentage to 92%. In November 2012,

we acquired the remaining 8% interest for $19 million and it became a wholly-owned subsidiary. The payment

for the remaining 8% interest was made in the fourth quarter of fiscal 2013.

Dividend Program: In January 2013, we announced a dividend program under which we intend to pay a

quarterly cash dividend beginning in the first quarter of fiscal 2014. The program is targeting a yield of

approximately 2.5% based on our closing stock price on May 1, 2013. On May 2, 2013, our board of directors

approved a quarterly dividend of $0.15 per share of common stock to be paid on June 27, 2013 to all

stockholders of record as of the close of business on June 19, 2013. The dividend policy, future declarations of

dividends, and payment dates will be subject to the board of directors’ continuing determination that the policy

and the declaration of dividends thereunder are in the best interest of our stockholders and are in compliance with

applicable law. The board of directors retains the power to modify, suspend, or cancel our dividend policy in any

manner and at any time that it may deem necessary or appropriate in the future.

Restructuring Plan: In the fourth quarter of fiscal 2013, we announced our strategic direction to streamline

and simplify the Company in order to deliver significantly improved performance to customers and partners. The

Company intends to focus on key strategic customer offerings and simplify our Go-To-Market strategy and

organizational structure. In order to deliver on this focus, the Company initiated a restructuring plan to reduce the

layers of management and redundant personnel resulting in headcount reductions across the Company. These

actions are expected to be completed in fiscal 2014. As of March 29, 2013, total cost incurred to date is $10

million, primarily related to severance and benefits. We expect to incur total severance and benefit costs between

$220 million and $250 million.

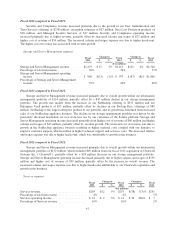

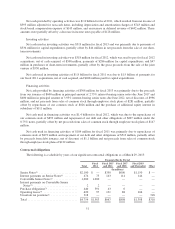

Cash Flows

The following table summarizes, for the periods indicated, selected items in our Consolidated Statements of

Cash Flows:

Fiscal

2013

Fiscal

2012

Fiscal

2011

($ in millions)

Net cash provided by (used in):

Operating activities ...................................... $1,593 $ 1,901 $ 1,794

Investing activities ....................................... (319) (318) (1,760)

Financing activities ...................................... 308 (1,386) (184)

Operating activities

Net cash provided by operating activities was $1.6 billion for fiscal 2013, which resulted from net income of

$765 million adjusted for non-cash items, including depreciation and amortization charges of $698 million and

stock-based compensation expense of $164 million, and an increase in deferred revenue of $119 million. These

amounts were partially offset by an increase in trade accounts receivable, net of $107 million.

Net cash provided by operating activities was $1.9 billion for fiscal 2012, which resulted from net income of

$1.2 billion adjusted for non-cash items, which largely included depreciation and amortization charges of $712

million, stock-based compensation expense of $164 million, an increase in deferred revenue of $177 million, a

decrease in trade accounts receivable, net of $89 million, and an increase in accounts payable and accrued

liabilities of $77 million. Additionally, net income was adjusted for the net gain of $526 million from the sale of

the joint venture with a subsidiary of Huawei Technologies Co., Limited, as the gross proceeds were included as

a cash inflow provided by investing activities.

50