Symantec 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

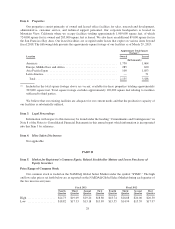

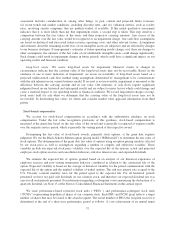

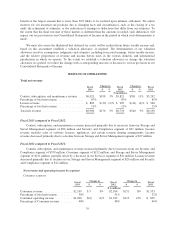

Item 6. Selected Financial Data

The following selected consolidated financial data is derived from our Consolidated Financial Statements.

This data should be read in conjunction with our Consolidated Financial Statements and related notes included in

this annual report and with Item 7, Management’s Discussion and Analysis of Financial Condition and Results of

Operations. Historical results may not be indicative of future results.

Five-Year Summary

Fiscal (a)

2013 2012 2011 2010 2009

(In millions, except per share data)

Consolidated Statements of Income Data:

Net revenue .................................... $ 6,906 $ 6,730 $ 6,190 $ 5,985 $ 6,150

Operating income (loss)(b) ......................... 1,123 1,079 880 933 (6,470)

Net income (loss) attributable to Symantec Corporation

stockholders(b)(c) ............................... $ 765 $ 1,172 $ 597 $ 714 $ (6,786)

Net income (loss) per share attributable to Symantec

Corporation stockholders — basic(b)(c) .............. $ 1.09 $ 1.58 $ 0.77 $ 0.88 $ (8.17)

Net income (loss) per share attributable to Symantec

Corporation stockholders — diluted(b)(c) ............ $ 1.08 $ 1.57 $ 0.76 $ 0.87 $ (8.17)

Weighted-average shares outstanding attributable to

Symantec Corporation stockholders — basic ........ 701 741 778 810 831

Weighted-average shares outstanding attributable to

Symantec Corporation stockholders — diluted ....... 711 748 786 819 831

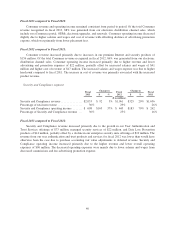

Consolidated Balance Sheet Data:

Cash and cash equivalents ......................... $ 4,685 $ 3,162 $ 2,950 $ 3,029 $ 1,793

Total assets(b) ................................... 14,379 13,020 12,719 11,232 10,638

Deferred revenue ................................ 3,496 3,444 3,321 2,835 2,644

Current portion of long-term debt(d) .................. 997 — 596 — —

Long-term debt(d)(e) ............................... 2,094 2,039 1,987 1,871 1,766

Long-term deferred revenue ........................ 521 529 498 371 419

Symantec Corporation stockholders’ equity(b) .......... $ 5,421 $ 5,094 $ 4,528 $ 4,548 $ 4,147

Noncontrolling interest in subsidiary ................. — 78 77 — —

Total stockholders’ equity(b) ........................ $ 5,421 $ 5,172 $ 4,605 $ 4,548 $ 4,147

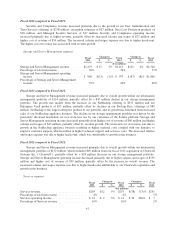

(a) We have a 52/53-week fiscal year. Fiscal 2013, 2012, 2011, and 2010 were each comprised of 52 weeks of

operations. Fiscal 2009 was comprised of 53 weeks of operations.

(b) During fiscal 2009, we recorded a non-cash goodwill impairment charge of $7.4 billion.

(c) In fiscal 2008, we formed a joint venture with a subsidiary of Huawei Technologies Co., Limited

(“Huawei”). In fiscal 2012, we sold our 49% ownership interest in the joint venture to Huawei for $530

million in cash. The gain of $530 million, offset by costs to sell the joint venture of $4 million, was included

in Gain from sale of joint venture in our fiscal 2012 Consolidated Statements of Income.

(d) In fiscal 2007, we issued $1.1 billion principal amount of 0.75% convertible senior notes (“0.75% notes”)

and $1.0 billion principal amount of 1.00% convertible senior notes (“1.00% notes”). In fiscal 2011, we

repurchased $500 million aggregate principal amount of our 0.75% notes. In fiscal 2012, the remaining

balance of our 0.75% notes matured and we settled with the holders with a cash payment of $600 million.

(e) In fiscal 2011, we issued $350 million in principal amount of 2.75% senior notes due September 2015

(“2.75% notes due 2015”) and $750 million in principal amount of 4.20% senior notes due September 2020

(“4.20% notes”). In fiscal 2013, we issued $600 million in principal amount of 2.75% senior notes due

June 2017 (“2.75% notes due 2017”) and $400 million in principal amount of 3.95% senior notes due June

2022 (“3.95% notes”).

31