Symantec 2013 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

Pretax income from international operations was $652 million, $891 million, and $460 million for fiscal

2013, fiscal 2012, and 2011, respectively.

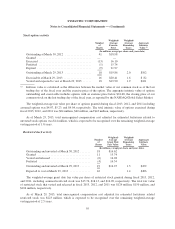

The difference between our effective income tax and the federal statutory income tax is as follows:

Year Ended

March 29,

2013

March 30,

2012

April 1,

2011

(In millions)

Expected Federal statutory tax .............................. $358 $515 $255

State taxes, net of federal benefit ............................ 25 12 12

Foreign earnings taxed at less than the federal rate .............. (96) (160) (84)

Domestic production activities deduction ..................... (12) (20) (9)

Federal research and development credit ...................... (10) (12) (10)

Valuation allowance increase (decrease) ...................... — 5 (15)

Benefit of losses from joint venture .......................... — (1) (2)

VERITAS tax positions (including valuation allowance release) . . . (9) (52) (49)

Other, net .............................................. 2 11 7

$ 258 $ 298 $ 105

The principal components of deferred tax assets are as follows:

As of

March 29,

2013

March 30,

2012

(In millions)

Deferred tax assets:

Tax credit carryforwards ......................................... $ 54 $ 43

Net operating loss carryforwards of acquired companies ................ 102 137

Other accruals and reserves not currently tax deductible ................ 144 152

Deferred revenue ............................................... 93 95

Loss on investments not currently tax deductible ...................... 10 23

State income taxes .............................................. 29 33

Goodwill ..................................................... — 36

Stock-based compensation ....................................... 36 60

Other ........................................................ — 4

468 583

Valuation allowance .............................................. (66) (55)

Total deferred tax assets ......................................... $402 $528

Deferred tax liabilities:

Tax over book depreciation ....................................... $ (73) $ (41)

Goodwill ..................................................... (19) —

Intangible assets ............................................... (102) (208)

Unremitted earnings of foreign subsidiaries .......................... (372) (329)

Other ........................................................ (3) —

Total deferred tax liabilities ...................................... $(569) $(578)

Net deferred tax assets ............................................ $(167) $ (50)

97