Symantec 2013 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

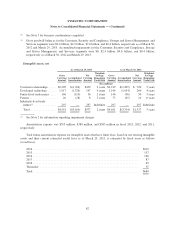

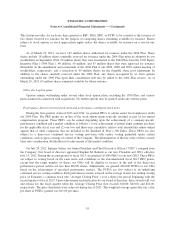

The following is a schedule by fiscal years of minimum future rentals on noncancelable operating leases as

of March 29, 2013 (in millions):

2014 ........................................................................ $ 97

2015 ........................................................................ 72

2016 ........................................................................ 59

2017 ........................................................................ 48

2018 ........................................................................ 40

Thereafter ................................................................... 104

Total minimum future lease payments ............................................. $420

Less: sublease income .......................................................... 3

Total minimum future lease payments, net .......................................... $417

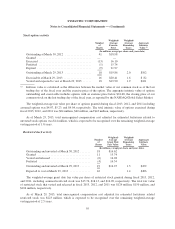

Purchase obligations

We have purchase obligations that are associated with agreements for purchases of goods or services.

Management believes that cancellation of these contracts is unlikely and we expect to make future cash payments

according to the contract terms. The following reflects unrecognized purchase obligations by fiscal years, as of

March 29, 2013 (in millions):

2014 ....................................................................... $391

2015 ....................................................................... 21

2016 ....................................................................... 22

2017 ....................................................................... 5

2018 ....................................................................... 1

Thereafter ................................................................... —

Total purchase obligations ...................................................... $440

Indemnification

In the ordinary course of business, we may provide indemnifications of varying scope and terms to

customers, vendors, lessors, business partners, subsidiaries and other parties with respect to certain matters,

including, but not limited to, losses arising out of our breach of agreements or representations and warranties

made by us. In addition, our bylaws contain indemnification obligations to our directors, officers, employees and

agents, and we have entered into indemnification agreements with our directors and certain of our officers to give

such directors and officers additional contractual assurances regarding the scope of the indemnification set forth

in our bylaws and to provide additional procedural protections. We maintain director and officer insurance,

which may cover certain liabilities arising from our obligation to indemnify our directors and officers. It is not

possible to determine the aggregate maximum potential loss under these indemnification agreements due to the

limited history of prior indemnification claims and the unique facts and circumstances involved in each particular

agreement. Such indemnification agreements might not be subject to maximum loss clauses. Historically, we

have not incurred material costs as a result of obligations under these agreements and we have not accrued any

liabilities related to such indemnification obligations in our Consolidated Financial Statements.

We provide limited product warranties and the majority of our software license agreements contain

provisions that indemnify licensees of our software from damages and costs resulting from claims alleging that

88