Symantec 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If this Proposal is approved, all outstanding stock awards granted under the 2004 Plan will continue to be

subject to the terms and conditions as set forth in the agreements evidencing such stock awards and the terms of

the applicable 2004 Plan, but no additional awards will be granted under the 2004 Plan. As of August 1, 2013,

62,185,630 shares remained available for future issuance under the 2004 Plan. We expect the 2004 Plan to expire

with approximately 51,000,000 shares available for future issuance and such shares will not carry over to the

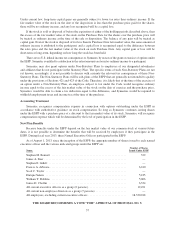

2013 Plan. The following table provides information about our common stock that may be issued upon the

exercise of options, warrants and rights under all of our existing equity compensation plans as of August 1, 2013:

Number of

Shares

Shares subject to outstanding awards under 2004 Plan and 1996 Equity Incentive Plan, or assumed

in connection with acquisitions ..................................................... 29,775,200

Outstanding options(1) ............................................................. 11,508,265

Outstanding full-value awards ....................................................... 18,266,935

Shares available for grant under the 2004 Plan(2) ........................................ 62,185,630

(1) Outstanding options have a weighted-average exercise price of $20.85 and a weighted-average remaining

term of 1.90 years.

(2) No more than 12,000,000 shares will be granted under the 2004 Plan between August 1, 2013 and

October 22, 2013. Any shares granted beyond 12,000,000 will reduce the maximum number of shares we

may grant under the 2013 Plan on a share for share basis. For purposes of determining the number of shares

granted under the 2004 Plan, each full-value award grant (e.g., restricted stock unit and performance-based

restricted stock unit) is treated as the equivalent of the grant of two options.

Summary of our 2013 Equity Incentive Plan

The following is a summary of the principal provisions of the 2013 Plan, as proposed for approval. This

summary does not purport to be a complete description of all of the provisions of the 2013 Plan. It is qualified in

its entirety by reference to the full text of the 2013 Plan. A copy of the 2013 Plan has been filed with the SEC

with this proxy statement, and any stockholder who wishes to obtain a copy of the 2013 Plan may do so by writ-

ten request to the Corporate Secretary at Symantec’s headquarters in Mountain View, California.

Eligibility. Employees (including officers), consultants, independent contractors, advisors and members of

the Board (including non-employee directors) are eligible to participate in the 2013 Plan. As of August 1, 2013,

there were approximately 33,919 employees and consultants, including six executive officers, and seven non-

employee directors that would have been eligible to receive awards under the 2013 Plan if the 2013 Plan had been

effective as of that date. Since our executive officers and non-employee directors may participate in the 2013 Plan,

each of our executive officers, non-employee directors and director nominees has an interest in Proposal No. 4.

Types of Awards. Awards that may be granted are stock options (both nonstatutory stock options and

incentive stock options (which may only be granted to employees)), restricted stock awards, RSUs (including

PRUs and PCSUs) and stock appreciation rights (each individually, an “award”).

Shares Reserved for Issuance. If Proposal No. 4 is approved, the total number of shares reserved for issu-

ance will be 45,000,000 shares. No shares reserved under the 2004 Plan will carry over to the 2013 Plan.

Shares Returned to the Plan. Shares that are subject to issuance upon exercise of an option but cease to be

subject to such option for any reason (other than exercise of such option), shares that are subject to an award that

is granted but is subsequently forfeited or repurchased by Symantec at the original issue price and shares that are

subject to an award that terminates without shares being issued will again be available for grant and issuance

under the 2013 Plan.

Shares Not Returned to the Plan. Shares that are withheld to pay the exercise or purchase price of an award

or to satisfy any tax withholding obligations in connection with an award, shares that are not issued or delivered as a

result of the net settlement of an outstanding option or SAR and shares that are repurchased on the open market with

the proceeds of an option exercise price will not be available again for grant and issuance under the 2013 Plan.

29