Symantec 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Awards

Certain business conditions may warrant using additional compensation approaches to attract, retain or

motivate executives. Such conditions include acquisitions and divestitures, attracting or retaining specific or

unique talent, and recognition for exceptional contributions. In these situations, the Compensation Committee

considers the business needs and the potential costs and benefits of special rewards. For example, in fiscal 2013,

the Compensation Committee determined that it should offer special incentives to attract Mr. Gillett because it

believed that we would need to offer him compensation that would neutralize the cash impact of his departure

from his then-current employer, where he had served for only nine months. In this regard, the Compensation

Committee awarded Mr. Gillett two one-time sign-on bonuses totaling $3,865,000 as an inducement to accept

our offer of employment. The amount of these one-time sign-on bonuses were designed to offset his forfeiture of

various bonuses and obligations, including $2,552,000 of previously-paid bonuses that Mr. Gillett was obligated

to repay, as a result of his departure from his then-current employer. The sign-on bonuses are subject to full or

partial repayment by Mr. Gillett if he voluntarily leaves our company or is terminated for cause within five years

of his start date as set forth in detail in the employment offer letter and as further described in the Summary

Compensation Table on page 70.

Other Benefits

All named executive officers are eligible to participate in our 401(k) plan (which includes our matching

contributions), health and dental coverage, life insurance, disability insurance, paid time off, and paid holidays on

the same terms as are available to all employees generally. These rewards are designed to be competitive with

overall market practices, and are in place to attract and retain the talent needed in the business. In addition,

named executive officers are eligible to participate in the deferred compensation plan, and to receive other bene-

fits described below.

Deferred Compensation: Symantec’s named executive officers are eligible to participate in a nonqualified

deferred compensation plan that provides management employees on our U.S. payroll with a base salary of

$150,000 or greater (including our named executive officers) the opportunity to defer up to 75% of base salary

and 100% of cash bonuses for payment at a future date. This plan is provided to be competitive in the executive

talent market, and to provide executives with a tax-efficient alternative for receiving earnings. One of our named

executive officers participated in this plan during fiscal 2013. The plan is described further under “Non-Qualified

Deferred Compensation in Fiscal 2013,” on page 78.

Additional Benefits: Symantec’s named executive officers typically do not receive perquisites, except in

limited circumstances when deemed appropriate by the Compensation Committee. For example, an additional

benefit available to named executive officers is reimbursement for up to $10,000 for financial planning services.

In addition, Mr. Gillett also received reasonable reimbursement for certain relocation expenses associated with

his move to the San Francisco Bay Area. The Compensation Committee provides certain perquisites because it

believes they are for business-related purposes or are prevalent in the marketplace for executive talent. The value

of the perquisites we provide is taxable to the named executive officers and the incremental cost to us for provid-

ing these perquisites is reflected in the Summary Compensation Table. (These benefits are disclosed in the All

Other Compensation column of the Summary Compensation Table on page 70).

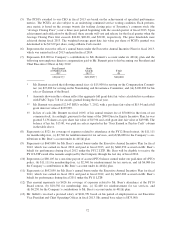

Change of Control and Severance Arrangements: Our Executive Retention Plan provides (and, in the

case of PRUs and PCSUs, the terms of the PRUs and PCSUs, respectively provide) participants with double trig-

ger acceleration of equity awards and, if applicable, become immediately exercisable, where equity vesting and

exercisability is only accelerated in the event the individual’s employment is terminated without cause, or is

constructively terminated, within 12 months after a change in control of our company (as defined in the plan). In

the case of PRUs, PRUs will vest at target if the change in control occurs prior to the first performance period,

will vest as to eligible shares if the change in control occurs following the first performance period but before

achievement is determined with respect to the second performance period, and will vest as to the sum of the

eligible shares determined to be earned for the second performance period plus 50% of the eligible shares if the

change in control occurs following the second performance period but before achievement is determined with

respect to the third performance period. In the case of the PCSUs granted during fiscal 2013, 225,000 shares (or,

65