Symantec 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

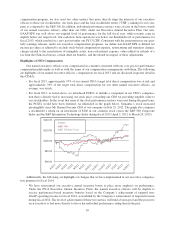

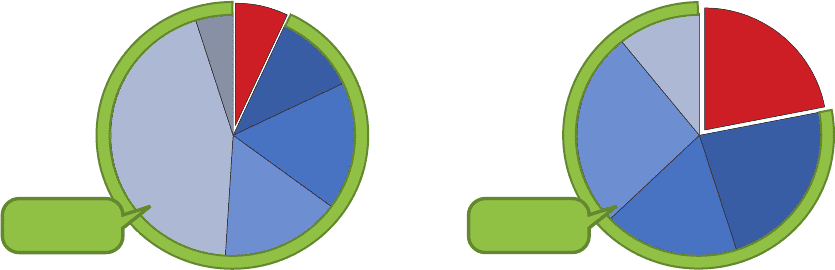

The percentage of an executive officer’s compensation opportunity that is “at-risk,” or variable instead of

fixed, is based primarily on the officer’s level of influence at Symantec. Executive officers generally have a

greater portion of their pay at risk through short-and long-term incentive programs than the rest of our employee

population because of their relatively greater responsibility and ability to influence our company’s performance.

Typically, a materially higher proportion of the CEO’s compensation opportunity is at-risk relative to our other

named executive officers because the nature of his role and ability to influence our company’s performance. As

illustrated by the following charts, for fiscal 2013, approximately 93% of our current CEO’s target total direct

compensation (sum of base salary, target annual incentive, target cash long-term-incentive and grant date fair

value of equity awards) was at-risk, and on average approximately 78% of our other named executive officers’

compensation opportunity was at-risk compensation, except for our former CEO who had approximately 91% of

his compensation opportunity in the form of at-risk compensation.

FY13 Current CEO Target Direct Compensation

Mix

Cash LTIP

5%

RSU 16%

PCSU* 44% PRU* 17%

Base

7%

Annual

Incentive

11%

At-Risk

Compensation:

93%

FY13 All Other NEOs Average Target Direct

Compensation Mix-Excl. Termed Officers

Cash LTIP

11%

RSU 26%

PRU* 18%

Base

22%

At-Risk

Compensation:

78%

Annual

Incentive

23%

Form and Mix of Long-Term Equity Incentive Compensation: The long-term equity incentive

compensation component of our regular annual executive compensation program consists of PRUs and restricted

stock units (“RSUs”) for all of our named executive officers and, beginning in fiscal 2013, PCSUs for our chief

executive officer. We allocated a significantly larger portion of the value of the CEO’s target total long-term

equity incentive award in the form of PCSUs and PRUs than in time-vested RSUs, as depicted in the chart above.

We believe these allocations strike the appropriate balance between performance and retention for long-term

equity incentive awards. We no longer offer stock options as a regular part of our annual executive compensation

program.

For fiscal 2013, our current CEO received approximately 44% of the value of his target total direct compen-

sation in the form of PCSUs, 17% in PRUs and 16% in RSUs. Other named executive officers received

(excluding our former CEO), on average, approximately 18% of the target value of their equity compensation in

the form of PRUs and 26% in RSUs. Our former CEO received approximately 34% of the value of his target

long-term equity incentive award compensation in the form of PRUs and 18% in RSUs.

These percentages (and other percentage-based equity awards values discussed below) are based on the

grant date fair value of the shares of common stock underlying the RSUs, and the grant date fair value of the

PRUs and PCSUs at the target level award size. The awards made to our named executive officers, other than the

CEO, are determined by the Compensation Committee after reviewing recommendations made by the CEO. In

determining its recommendations to the independent directors of the Board, in the case of CEO compensation,

and in making compensation decisions with respect to other named executive officers, the Compensation

Committee may consider factors such as the individual’s responsibilities, the individual’s performance, industry

experience, current pay mix, total compensation competitiveness, long-term equity and cash awards previously

granted to the individual, retention considerations, and other factors.

54