Symantec 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

Go-To-Market

We are in the process of signicantly changing our go-to-market (GTM) plans in order to

improve both the effectiveness and efciency of our sales and marketing. We are upgrading the

talent and capability of both our marketing and sales organizations. The key highlights are the

following:

1. Sales force focus on new license: We will separate the renewals sales process from

the new license sales process by creating a eld sales force focused and compensated on

generating new business only. We will have a sales force of hunters versus a combination of

hunters and farmers.

2. New renewals team: We will create a centrally managed renewals team that will focus

exclusively on this important revenue stream. This is a large opportunity to improve the value

we deliver for customers as our previous approach was both high cost and low quality relative

to peer benchmarks.

3. Sales force specialization: We will reorganize our eld sales force into two specialized roles,

one focused on information security and the other on information management. This concept

has been well received by both customers and our sales force as the focus will drive deeper

product expertise and improve our execution.

4. New channel strategy: Finally, we are completely revamping our channel strategy to better

align our offerings with the optimal route to market and our channel partners’ capability. We

will align the economics and incentives based on the value created by the partner and expect

this will result in fewer, more focused, and successful partners.

People, Process, and Technology Infrastructure

Having the right strategy is critical to any company’s success, but value is created through

execution. In order to dramatically improve the quality, consistency, and efciency of our

execution we are focused on a few key things:

1. Simplify: We believe there is a large opportunity to simplify many customer and partner

facing aspects of our company to become much less complex and easier to do business with.

2. Streamline: We’ve eliminated middle management and removed some redundancies across

the organization to improve our responsiveness and decision making.

3. WorkSmart: We are implementing a concept we are calling WorkSmart. In simple terms,

this is about choosing the work we do wisely and then working hard every day to improve

how we do that work through a rigorous focus on people, process, and technology. We believe

WorkSmart will unleash the energy of our team and empower our employees from top to

bottom to do the right thing for customers and partners which will help us both accelerate

growth and improve margins.

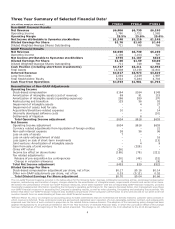

FISCAL 2013 FINANCIAL REVIEW

Our combination of focus and discipline enabled us to deliver record nancial results even

during this time of signicant transition. We achieved organic revenue growth of 3%, the highest

in 3 years, driven by strength in our enterprise backup, information security, and endpoint security

offerings.

•GAAP revenue of $6.9 billion grew 5% in constant currency from the previous year.

•Non-GAAP1 operating margin decreased by 10 basis points to 25.5%.

•Non-GAAP earnings per share of $1.76 grew 8%.

•GAAP deferred revenue posted a record $4 billion, up 3% in constant currency, driven by our

sales mix shift to subscriptions.

• Cash ow from operations was $1.6 billion, down 16% driven by reduced collections due

to weak billings at the end of the March 2012 quarter as well as higher cost of goods sold,

restructuring costs, and cash tax payments.

1Non-GAAP results are reconciled to GAAP on page 4