Symantec 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

benefit as the largest amount that is more than 50% likely to be realized upon ultimate settlement. We adjust

reserves for our uncertain tax positions due to changing facts and circumstances, such as the closing of a tax

audit, the refinement of estimates, or the realization of earnings or deductions that differ from our estimates. To

the extent that the final outcome of these matters is different than the amounts recorded, such differences will

impact our tax provision in our Consolidated Statements of Income in the period in which such determination is

made.

We must also assess the likelihood that deferred tax assets will be realized from future taxable income and,

based on this assessment establish a valuation allowance, if required. The determination of our valuation

allowance involves assumptions, judgments and estimates, including forecasted earnings, future taxable income,

and the relative proportions of revenue and income before taxes in the various domestic and international

jurisdictions in which we operate. To the extent we establish a valuation allowance or change the valuation

allowance in a period, we reflect the change with a corresponding increase or decrease to our tax provision in our

Consolidated Statements of Income.

RESULTS OF OPERATIONS

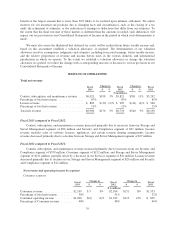

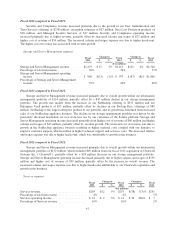

Total net revenue

Fiscal

2013

Change in Fiscal

2012

Change in Fiscal

2011$ % $ %

($ in millions)

Content, subscription, and maintenance revenue .... $6,021 $198 3% $5,823 $581 11% $5,242

Percentage of total net revenue ................. 87% 87% 85%

License revenue ............................. $ 885 $(22) (2)% $ 907 $ (41) (4)% $ 948

Percentage of total net revenue ................. 13% 13% 15%

Total net revenue ............................ $6,906 $176 3% $6,730 $540 9% $6,190

Fiscal 2013 compared to Fiscal 2012:

Content, subscription, and maintenance revenue increased primarily due to increases from our Storage and

Server Management segment of $94 million and Security and Compliance segment of $91 million. License

revenue includes sales of software licenses, appliances, and certain revenue sharing arrangements. License

revenue decreased primarily due to a decline from our Storage and Server Management segment of $27 million.

Fiscal 2012 compared to Fiscal 2011:

Content, subscription, and maintenance revenue increased primarily due to increases from our Security and

Compliance segment of $339 million, Consumer segment of $152 million, and Storage and Server Management

segment of $131 million, partially offset by a decrease in our Services segment of $41 million. License revenue

decreased primarily due to declines in our Storage and Server Management segment of $29 million and Security

and Compliance segment of $12 million.

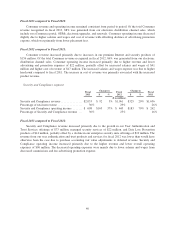

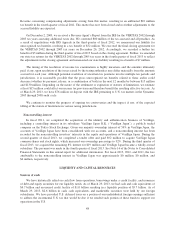

Net revenue and operating income by segment

Consumer segment

Fiscal

2013

Change in Fiscal

2012

Change in Fiscal

2011$ % $ %

($ in millions)

Consumer revenue .................... $2,109 $ 5 0% $2,104 $151 8% $1,953

Percentage of total net revenue .......... 30% 31% 32%

Consumer operating income ............ $1,006 $(6) (1)% $1,012 $113 13% $ 899

Percentage of Consumer revenue ........ 48% 48% 46%

39