Symantec 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

‰We have discontinued using a long-term cash incentive award as a component of our long-term executive

compensation program. Instead, our long-term compensation will be comprised entirely of long-term

equity incentive awards to better align the interests of our executives with those of our stockholders.

‰Based in part on feedback obtained from our ongoing engagement with stockholders and their advisers,

our Compensation Committee adjusted our peer group to include companies that are more similar to us in

terms of complexity, global reach and revenue and market capitalization. They selected primarily busi-

nesses with an intense software development focus, and software and engineering-driven companies that

compete with us for executive and broader talent.

‰We have eliminated the duplication of the targeted non-GAAP EPS metric in both the cash annual

incentive plan and the PRU equity incentive plan. In fiscal 2014, the cash annual incentive plan metric

will be non-GAAP operating income, which we believe our executives have a more direct ability to affect.

‰To enhance the alignment between our executive officers and stockholder interests, in July 2013 we

increased the level of our stock ownership guidelines for our Chief Operating Officer and President,

Products and Services so that they have a minimum holding requirement of 3x their base salaries.

“Say on Pay” Advisory Vote on Executive Compensation

We hold an advisory vote on executive compensation, commonly known as “Say-on-Pay,” on an annual

basis. While these votes are not binding, we believe that it is important for our stockholders to have an oppor-

tunity to express their views regarding our executive compensation programs and philosophy as disclosed in our

proxy statement on an annual basis. The Compensation Committee values our stockholders’ opinions and the

Board and the Compensation Committee consider the outcome of each vote when making future compensation

decisions for our named executive officers. In addition to the annual advisory vote on executive compensation,

we are committed to ongoing engagement with our stockholders on executive compensation matters generally.

These engagement efforts take place through telephone calls, in-person meetings and correspondence with our

stockholders.

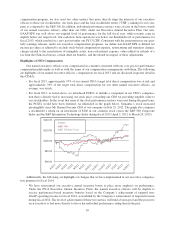

We have received approximately 98% and 97% of the votes cast on the advisory vote in favor of our execu-

tive compensation in fiscal 2011 and fiscal 2012, respectively. The Board and the Compensation Committee

considered these favorable outcomes and believed they conveyed our stockholders’ support of our existing

executive compensation philosophy and programs; therefore, these outcomes did not have a material impact on

executive compensation decisions and policies for fiscal 2013. Nonetheless, the Compensation Committee

introduced a few changes to the structure of our executive compensation programs for fiscal 2014 based on feed-

back received from a majority of our top 100 investors and their advisers. The Compensation Committee adjusted

our peer group as described further on page 52. The Compensation Committee also changed the metrics for our

cash annual incentive plans for fiscal 2014 so that the same metrics are not used for our all of our performance-

based compensation, including PRU awards, as described starting on page 49.

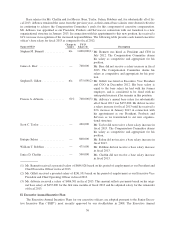

Roles of Our Compensation Committee, Executive Officers and Consultants in our Compensation Process

The Compensation Committee, which is comprised entirely of independent directors, is responsible for

overseeing all of Symantec’s compensation programs, including the review and recommendation to the

independent directors of our Board of all compensation arrangements for our CEO and the review and approval

of the compensation payable to our other named executive officers.

The independent directors of the Board evaluate the CEO’s performance and the Compensation Committee

then reviews and recommends to the independent members of the Board all compensation arrangements for the

CEO. After discussion, the independent members of the Board determine the CEO’s compensation. The

Compensation Committee also discusses the performance of the other named executive officers with the CEO,

reviews the compensation recommendations that the CEO submits for the other named executive officers, makes

any appropriate adjustments, and approves their compensation. While our CEO provides input and makes com-

pensation recommendations with respect to executive officers other than himself, our CEO does not make

recommendations with respect to his own compensation or participate in the deliberations regarding the setting of

his own compensation by the Board or the Compensation Committee.

50