Symantec 2013 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

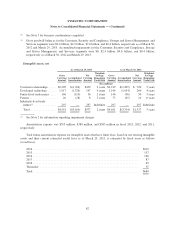

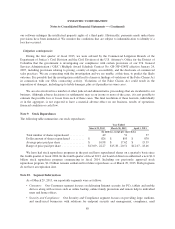

(3) See Note 3 for business combinations completed.

(4) Gross goodwill balances for the Consumer, Security and Compliance, Storage and Server Management, and

Services segments were $0.4 billion, $4.9 billion, $7.6 billion, and $0.4 billion, respectively as of March 30,

2012 and March 29, 2013. Accumulated impairments for the Consumer, Security and Compliance, Storage

and Server Management, and Services segments were $0, $2.4 billion, $4.6 billion, and $0.4 billion,

respectively as of March 30, 2012 and March 29, 2013.

Intangible assets, net

As of March 29, 2013 As of March 30, 2012

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted-

Average

Remaining

Useful Life

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Weighted-

Average

Remaining

Useful Life

($ in millions)

Customer relationships ..... $2,205 $(1,766) $439 2 years $2,219 $(1,499) $ 720 3 years

Developed technology ...... 1,917 (1,720) 197 4 years 1,914 (1,654) 260 4 years

Finite-lived trade names .... 146 (110) 36 2 years 146 (96) 50 3 years

Patents .................. 26 (18) 8 5 years 75 (65) 10 6 years

Indefinite-lived trade

names(1) ............... 297 — 297 Indefinite 297 — 297 Indefinite

Total ................. $4,591 $(3,614) $977 2 years $4,651 $(3,314) $1,337 3 years

(1) See Note 2 for information regarding impairment charges.

Amortization expense was $355 million, $380 million, and $385 million in fiscal 2013, 2012, and 2011,

respectively.

Total future amortization expense for intangible assets that have finite lives, based on our existing intangible

assets and their current estimated useful lives as of March 29, 2013, is estimated by fiscal years as follows

(in millions):

2014 ........................................................................ $210

2015 ........................................................................ 157

2016 ........................................................................ 106

2017 ........................................................................ 87

2018 ........................................................................ 65

Thereafter ................................................................... 55

Total ....................................................................... $680

82