Symantec 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

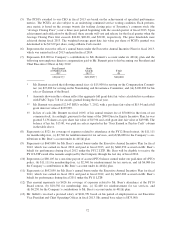

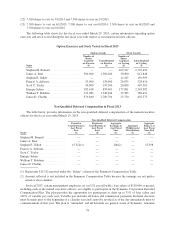

(5) The PCSUs awarded to our CEO in fiscal 2013 are based on the achievement of specified performance

metrics. The PCSUs are also subject to an underlying continued service vesting condition. Each perform-

ance metric is based on the average twenty day trailing closing price of Symantec’s common stock (the

“Average Closing Price”) over a three-year period beginning with the second quarter of fiscal 2013. Upon

achievement and ratification by the Board, these awards will vest and release for the fiscal quarter when the

Average Closing Price first exceeds $18.00, $20.00, and $22.00, respectively. The price thresholds were

achieved during fiscal 2013. The weighted-average grant date fair value per share of PCSUs granted was

determined to be $13.69 per share, using a Monte Carlo model.

(6) Represents the executive officer’s annual bonus under the Executive Annual Incentive Plan for fiscal 2013,

which was earned in fiscal 2013 and paid in fiscal 2014.

(7) Represents $12,000 in Company’s contributions to Mr. Bennett’s account under its 401(k) plan and the

following non-employee director compensation paid to Mr. Bennett prior to his becoming our President and

Chief Executive Officer in July 2012:

Fees Earned

or Paid in Cash

($)*

Stock

Awards

($)†**

Total

($)

130,013†† 249,987†† 380,000

* Mr. Bennett received the following annual fees: (i) $15,000 for serving on the Compensation Commit-

tee; (ii) $15,000 for serving on the Nominating and Governance Committee; and (iii) $100,000 for his

role as Chairman of the Board.

†Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance

with FASC Topic 718 for awards granted during the fiscal year.

** Mr. Bennett was granted 12,547 RSUs on May 7, 2012, with a per share fair value of $15.94 and a full

grant date fair value of $199,999.

†† In lieu of cash, Mr. Bennett received 100% of his annual retainer fee of $50,000 in the form of our

common stock. Accordingly, pursuant to the terms of the 2000 Director Equity Incentive Plan, he was

granted 3,136 shares at a per share fair value of $15.94 and a full grant date fair value of $49,988. The

balance of his fee, $13.00, was paid in cash as reported in the “Fees Earned or Paid in Cash” column

in the table above.

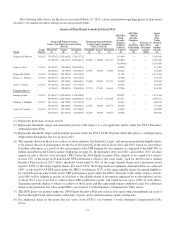

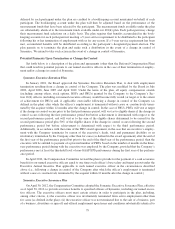

(8) Represents (a) $521 for coverage of expenses related to attendance at the FY12 Board retreat, (b) $11,111

for membership fees, (c) $2,740 for reimbursement for tax services, and (d) $6,000 for the Company’s con-

tributions to Mr. Beer’s account under its 401(k) plan.

(9) Represents (a) $665,000 for Mr. Beer’s annual bonus under the Executive Annual Incentive Plan for fiscal

2012, which was earned in fiscal 2012 and paid in fiscal 2013, and (b) $446,250 accrued on Mr. Beer’s

behalf for performance during fiscal 2012 under the FY12 LTIP. Mr. Beer will be eligible to receive the

FY12 LTIP award if he remains employed by the Company through the last day of fiscal 2014.

(10) Represents (a) $80,105 for a one-time payout of accrued PTO balance earned under our paid-time off (PTO)

policy, (b) $11,111 for membership fees, (c) $2,340 for reimbursement for tax services, and (d) $6,000 for

the Company’s contributions to Mr. Beer’s account under its 401(k) plan.

(11) Represents (a) $652,050 for Mr. Beer’s annual bonus under the Executive Annual Incentive Plan for fiscal

2011, which was earned in fiscal 2011 and paid in fiscal 2012, and (b) $465,000 accrued on Mr. Beer’s

behalf for performance during fiscal 2011 under the FY11 LTIP.

(12) This amount represents (a) $426 for coverage of expenses related to Mr. Beer’s attendance at the FY10

Board retreat, (b) $10,556 for membership fees, (c) $2,400 for reimbursement for tax services, and

(d) $6,250 for the Company’s contributions to Mr. Beer’s account under its 401(k) plan.

(13) Mr. Gillett’s received a prorated salary of $241,951 based on his period of employment as our Executive

Vice President and Chief Operating Officer in fiscal 2013. His annual base salary is $875,000.

72