Symantec 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

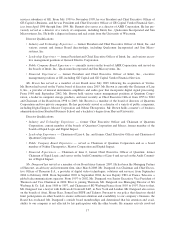

Director Compensation

The following table provides information for fiscal year 2013 compensation for all of our non-employee

directors:

Fiscal Year 2013 Director Compensation

Name*

Fees Earned

or Paid in

Cash

($)(1)(2)

Stock

Awards

($)(3)(4)

Option

Awards

($)(5)

Total

($)

Michael A. Brown .............................. 100,001 199,999 — 300,000

Frank E. Dangeard .............................. 85,001 199,999 — 285,000

Geraldine B. Laybourne ......................... 65,001 199,999 — 265,000

David L. Mahoney(6) ........................... 85,440 199,999 — 285,439

Robert S. Miller ................................ 35,013 249,987(7) — 285,000

Daniel H. Schulman(8) .......................... 152,913 199,999 — 352,912

V. Paul Unruh ................................. 95,001 199,999 — 295,000

* During fiscal 2013, Messrs. Bennett and Gillett served as directors prior to their appointment as executive

officers of our company. The non-employee director compensation paid to them in fiscal 2013 is reported in

the Summary Compensation Table above under the column captioned “All Other Compensation.”

(1) Non-employee directors receive an annual retainer fee of $50,000 plus an additional annual fee of $15,000

(Compensation Committee and Nominating and Governance Committee) or $20,000 (Audit Committee) for

membership on each committee. The chair of each committee receives an additional annual fee of $15,000

(Compensation Committee and Nominating and Governance Committee) or $25,000 (Audit Committee).

(2) Includes cash payout of $0.82 for fractional share from stock awards granted to each non-employee director.

(3) Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance with

FASC Topic 718 for awards granted during the fiscal year.

(4) Each non-employee director was granted 12,547 RSUs on May 7, 2012, with a per share fair value of $15.94

and a full grant date fair value of $199,999.

(5) In fiscal years 2013, 2012 and 2011, there were no stock option grants to any person who served as a non-

employee director. The outstanding stock options held by each non-employee director at 2013 fiscal year-end

were: Mr. Brown (12,000), Mr. Mahoney (36,000), Mr. Miller (36,000), Mr. Schulman (36,000), and

Mr. Unruh (180,630).

(6) Mr. Mahoney was appointed Chairman to the Nominating and Governance Committee, effective July 25,

2012. As a result, Mr. Mahoney received pro-rated Nominating and Governance Committee membership and

chairman retainer fees of $10,219.78.

(7) In lieu of cash, Mr. Miller received 100% of his annual retainer fee of $50,000 in the form of our common

stock. Accordingly, pursuant to the terms of the 2000 Director Equity Incentive Plan, he was granted 3,136

shares at a per share fair value of $15.94 and a full grant date fair value of $49,988. The balance of his fee

was paid in cash as reported in the “Fees Earned or Paid in Cash” column in the table above.

(8) Mr. Schulman was appointed Lead Independent Director, effective July 25, 2012. As a result, he received a

pro-rated annual fee of $100,000 in the amount of $68,132. Mr. Schulman also resigned as Chairman of the

Compensation Committee, effective July 25, 2012, and therefore, a pro-rated Compensation Committee

Chairman fee of $10,220 was deducted from his Lead Independent Director fee resulting in a total of $57,912

paid to Mr. Schulman for his role as Lead Independent Director in fiscal 2013.

Director Stock Ownership Guidelines: Since May 2007, the Compensation Committee has instituted the

following stock ownership guidelines to better align our directors’ interests with those of our stockholders:

‰Directors must maintain a minimum holding of 10,000 shares of Symantec stock;

‰New directors will have three years to reach the minimum holding level; and

22