Symantec 2013 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

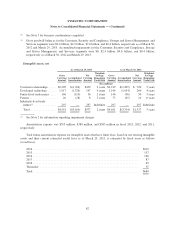

Note 11. Employee Benefits and Stock-Based Compensation

401(k) plan

We maintain a salary deferral 401(k) plan for all of our domestic employees. This plan allows employees to

contribute up to 50% of their pretax salary up to the maximum dollar limitation prescribed by the Internal

Revenue Code. We match 50% of the employee’s contribution up to the limits specified in the plan. The

maximum match in any given plan year is 3% of the employees’ eligible compensation, up to $6,000. Our

contribution under the plan was $26 million, $25 million, and $22 million in fiscal 2013, 2012, and 2011,

respectively.

Stock purchase plans

2008 Employee Stock Purchase Plan

In September 2008, our stockholders approved the 2008 Employee Stock Purchase Plan (“2008 ESPP”) and

reserved 20 million shares of common stock for issuance thereunder. In September 2010, the 2008 ESPP was

amended by our stockholders to increase the shares available for issuance thereunder by 20 million. As of

March 29, 2013, 18 million shares have been issued under this plan and 22 million shares remained available for

future issuance.

Subject to certain limitations, our employees may elect to have 2% to 10% of their compensation withheld

through payroll deductions to purchase shares of common stock under the 2008 ESPP. Employees purchase

shares of common stock at a price per share equal to 85% of the fair market value on the purchase date at the end

of each six-month purchase period.

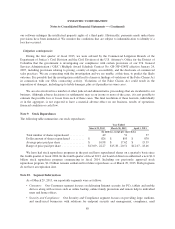

Stock award plans

2000 Director Equity Incentive Plan

In September 2000, our stockholders approved the 2000 Director Equity Incentive Plan and reserved

50,000 shares of common stock for issuance thereunder. Stockholders increased the number of shares of stock

that may be issued by 50,000 in September 2004, September 2007, and October 2011. The purpose of this plan is

to provide the members of the board of directors with an opportunity to receive common stock for all or a portion

of the retainer payable to each director for serving as a member. Each director may elect any portion up to 100%

of the retainer to be paid in the form of stock. As of March 29, 2013, a total of 132,872 shares have been issued

under this plan and 67,128 shares remained available for future issuance.

2004 Equity Incentive Plan

Under the 2004 Equity Incentive Plan (“2004 Plan”), our board of directors, or a committee of the board of

directors, may grant incentive and nonqualified stock options, stock appreciation rights, RSUs, RSAs, PRUs or

PCSUs to employees, officers, directors, consultants, independent contractors, and advisors to us. These may also

be issued to any parent, subsidiary, or affiliate of ours. The purpose of the 2004 Plan is to attract, retain, and

motivate eligible persons whose present and potential contributions are important to our success by offering them

an opportunity to participate in our future performance through equity awards of stock options and stock bonuses.

Under the terms of the 2004 Plan, the exercise price of stock options may not be less than 100% of the fair

market value on the date of grant. Stock options and RSUs generally vest over a four-year period. Stock options

granted prior to October 2005 generally have a maximum term of ten years and options granted thereafter

generally have a maximum term of seven years. An important feature of the 2004 Plan is “fungible share pool”.

92