Symantec 2013 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

•Level 3: Unobservable inputs reflecting our own assumptions incorporated in valuation techniques

used to determine fair value. These assumptions are required to be consistent with market participant

assumptions that are reasonably available.

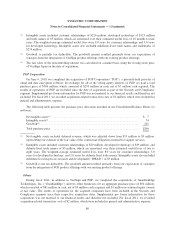

Assets measured and recorded at fair value on a recurring basis

There have been no transfers between fair value measurement levels during fiscal 2013. The following table

summarizes our assets measured at fair value on a recurring basis, by level, within the fair value hierarchy:

As of March 29, 2013 As of March 30, 2012

Level 1 Level 2 Total Level 1 Level 2 Total

(In millions)

Cash equivalents(1) ................................ $3,469 $— $3,469 $1,483 $— $1,483

Marketable equity securities ........................ 62 — 62 5 — 5

(1) Cash equivalents consist of investments with remaining maturities of three months or less at the date of

purchase, or money market funds for which the carrying amount is a reasonable estimate of fair value.

Assets and liabilities measured and recorded at fair value on a nonrecurring basis

Goodwill. In fiscal 2012, we recorded an impairment of $19 million as a cumulative-effect adjustment in

Accumulated deficit, related to an implied fair value measurement made for our Services reporting unit upon the

adoption of a new accounting standard. The valuation technique used to estimate the implied fair value of

goodwill was an income approach which relied upon Level 3 inputs, which included discounted estimated future

cash flows or profit streams.

Indefinite-lived intangible assets. In fiscal 2012 and 2011, we recorded impairment charges of $4 million

and $27 million, respectively, which reduced the gross carrying value of indefinite-lived trade names. The fair

value amounts were derived using an income approach which required Level 3 inputs such as discounted

estimated future cash flows on profit streams. These impairment charges were due to reductions in expected

future cash flows for certain indefinite-lived trade names related to the Security and Compliance segment and the

Consumer segment, respectively. These impairment charges were recorded within Impairment of intangible

assets in our Consolidated Statements of Income.

Debt. In fiscal 2011, we repurchased $500 million of aggregate principal amount of our 0.75% convertible

senior notes, which had a net book value of $481 million. Concurrently with the repurchase, we sold a

proportionate share of the initial note hedges back to the note hedge counterparties for approximately $13

million. These transactions resulted in a loss from extinguishment of debt of approximately $16 million, which

represented the difference between book value of the notes net of the remaining unamortized discount prior to

repurchase and the fair value of the liability component of the notes upon repurchase. The fair value of the

liability component was calculated to be $497 million upon repurchase using Level 2 inputs based on market

prices for similar convertible debt instruments and resulting yields.

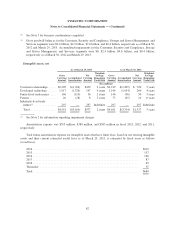

Note 3. Business Combinations

Fiscal 2013

On April 2, 2012, we completed the acquisition of a privately-held provider of mobile application

management. In exchange for all of the voting equity interests of the acquired company, we paid a total purchase

price of $28 million in cash. The objective of the acquisition is to extend our enterprise mobility portfolio to

77