Symantec 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

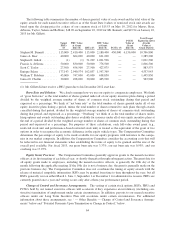

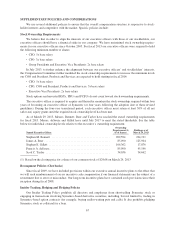

The following table summarizes the number of shares granted, value of each award and the total value of the

equity awards for each named executive officer as of the Grant Date (values of restricted stock unit awards are

based upon the closing price for a share of our common stock of $15.53 on May 10, 2012 for Messrs. Beer,

deSouza, Taylor, Salem and Robbins; $18.96 on September 10, 2012 for Mr. Bennett; and $19.94 on January 10,

2013 for Mr. Gillett).

Target

PRUs

(#)

PRU Value

at Grant

Date ($) RSUs (#)

RSU Value

at Grant

Date ($) PCSUs (#)

PCSUs

Value at

Grant

Date ($)

Total Target

Equity Incentive

Awards

Value at

Grant Date($)

Stephen M. Bennett ........ 115,000 2,410,400 115,000 2,180,400 450,000 6,156,000 10,746,800

James A. Beer ............ 40,000 664,000 40,000 621,200 — — 1,285,200

Stephen E. Gillett .......... (1) (1) 51,229 1,021,506 — — 1,021,506

Francis A. deSouza ........ 50,000 830,000 50,000 776,500 — — 1,606,500

Scott C. Taylor ............ 27,500 456,500 27,500 427,075 — — 883,575

Enrique Salem ............ 177,143 2,940,574 102,857 1,597,369 — — 4,537,943

William T. Robbins ........ 45,000 747,000 45,000 698,850 — — 1,445,850

Janice D. Chaffin .......... 30,000 498,000 30,000 465,900 — — 963,900

(1) Mr. Gillett did not receive a PRU grant due to his December 2012 start date.

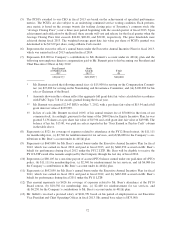

Burn Rate and Dilution: We closely manage how we use our equity to compensate employees. We think

of “gross burn rate” as the total number of shares granted under all of our equity incentive plans during a period

divided by the weighted average number of shares of common stock outstanding during that period and

expressed as a percentage. We think of “net burn rate” as the total number of shares granted under all of our

equity incentive plans during a period, minus the total number of shares returned to such plans through awards

cancelled during that period, divided by the weighted average number of shares of common stock outstanding

during that period, and expressed as a percentage. “Overhang” we think of as the total number of shares under-

lying options and awards outstanding plus shares available for issuance under all of our equity incentive plans at

the end of a period divided by the weighted average number of shares of common stock outstanding during that

period and expressed as a percentage. For purposes of these calculations, each full-value award grant (e.g.,

restricted stock unit and performance-based restricted stock unit) is treated as the equivalent of the grant of two

options in order to recognize the economic difference in the equity vehicle types. The Compensation Committee

determines the percentage of equity to be made available for our equity programs with reference to the compa-

nies in our market composite. In addition, the Compensation Committee considers the accounting costs that will

be reflected in our financial statements when establishing the forms of equity to be granted and the size of the

overall pool available. For fiscal 2013, our gross burn rate was 3.37%, our net burn rate was 0.93%, and our

overhang was 17.95%.

Equity Grant Practices: The Compensation Committee generally approves grants to the named executive

officers at its first meeting of each fiscal year, or shortly thereafter through subsequent action. The grant date for

all equity grants made to employees, including the named executive officers, is generally the 10th day of the

month following the applicable meeting. If the 10th day is not a business day, the grant is generally made on the

previous business day. The Compensation Committee does not coordinate the timing of equity awards with the

release of material, nonpublic information. RSUs may be granted from time to time throughout the year, but all

RSUs generally vest on either March 1, June 1, September 1 or December 1 for administrative reasons. PRUs are

currently granted once a year and vesting occurs only after a three-year performance period.

Change of Control and Severance Arrangements: The vesting of certain stock options, RSUs, PRUs and

PCSUs held by our named executive officers will accelerate if they experience an involuntary (including con-

structive) termination of employment under certain circumstances. In addition, payouts to our named executive

officers under our Long Term Incentive Plan will accelerate under certain circumstances. For additional

information about these arrangements, see “ — Other Benefits — Change of Control and Severance Arrange-

ments” below and “Potential Payments Upon Termination or Change in Control,” below.

64