Symantec 2013 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SYMANTEC CORPORATION

Notes to Consolidated Financial Statements — (Continued)

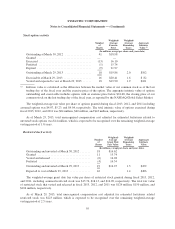

Stock options activity

Number

of

Shares

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Years

Aggregate

Intrinsic

Value (1)

(In millions, except per share and years data)

Outstanding at March 30, 2012 .................. 41 $18.98

Granted ..................................... — —

Exercised .................................... (13) 16.10

Forfeited .................................... (1) 15.74

Expired ..................................... (9) 21.97

Outstanding at March 29, 2013 .................. 18 $19.86 2.0 $102

Exercisable at March 29, 2013 ................... 16 $20.41 1.6 $ 82

Vested and expected to vest at March 29, 2013 ...... 18 $19.90 1.9 $101

(1) Intrinsic value is calculated as the difference between the market value of our common stock as of the last

trading day of the fiscal year and the exercise price of the option. The aggregate intrinsic value of options

outstanding and exercisable includes options with an exercise price below $24.68, the closing price of our

common stock on the last trading day of the fiscal year, as reported by the NASDAQ Global Select Market.

The weighted-average fair value per share of options granted during fiscal 2013, 2012, and 2011 including

assumed options was $4.07, $5.23, and $4.04, respectively. The total intrinsic value of options exercised during

fiscal 2013, 2012, and 2011 was $64 million, $40 million, and $43 million, respectively.

As of March 29, 2013, total unrecognized compensation cost adjusted for estimated forfeitures related to

unvested stock options was $14 million, which is expected to be recognized over the remaining weighted-average

vesting period of 1.8 years.

Restricted stock activity

Number

of

Shares

Weighted-

Average

Grant Date

Fair Value

Weighted-

Average

Remaining

Years

Aggregate

Intrinsic

Value

(In millions, except per share and years data)

Outstanding and unvested at March 30, 2012 ....... 18 $16.62

Granted .................................... 11 15.74

Vested and released ........................... (6) 16.28

Forfeited ................................... (4) 16.34

Outstanding and unvested at March 29, 2013 ....... 19 $16.25 1.5 $472

Expected to vest at March 29, 2013 .............. 16 1.4 $406

The weighted-average grant date fair value per share of restricted stock granted during fiscal 2013, 2012,

and 2011, including assumed restricted stock was $15.74, $18.13, and $14.96, respectively. The total fair value

of restricted stock that vested and released in fiscal 2013, 2012, and 2011 was $124 million, $150 million, and

$104 million, respectively.

As of March 29, 2013, total unrecognized compensation cost adjusted for estimated forfeitures related

restricted stock was $223 million, which is expected to be recognized over the remaining weighted-average

vesting period of 2.5 years.

95