Symantec 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1) Mr. Bennett received a prorated award payout based on his period of employment as our President and Chief

Executive Officer in fiscal 2013.

(2) Mr. Gillett’s received a prorated award based on his period of employment as our Executive Vice President

and Chief Operating Officer in fiscal 2013.

(3) Mr. deSouza’s award reflects a payment based on his original base salary for the first nine months of fiscal

2013 and his adjusted salary for the remainder of fiscal 2013.

(4) Messrs. Salem and Robbins were not eligible for an award since they were not employed with us at the end

of fiscal 2013.

III. Long Term Incentive Plan (LTIP)

In April 2012, the Compensation Committee approved our long term incentive plan for fiscal 2013 (FY13

LTIP). Under the terms of this plan, named executive officers were eligible to receive performance-based com-

pensation based upon the level of attainment of target operating cash flow for the fiscal year ending March 29,

2013. The Compensation Committee believes that the plan provided an ongoing retention and performance

incentive by balancing the restricted stock unit and performance-based restricted stock unit vesting periods (four

years and three years, respectively) with a component that enhances the alignment to long-term financial

performance. The FY13 LTIP was adopted pursuant to the SEIP most recently approved by our stockholders in

2008.

FY13 LTIP Target Opportunities: The target bonus amounts under the FY13 LTIP were $750,000 for

Stephen M. Bennett; $425,000 for Ms. Chaffin and Messrs. Beer, deSouza and Robbins; $350,000 for

Mr. Taylor; and $2,100,000 for Mr. Salem. Mr. Gillett did not participate in the FY13 LTIP due to his December

2012 start date.

FY13 LTIP Performance Measure and Target Setting: Under the FY13 LTIP, the long-term incentive

metric was measured at the end of the one-year performance period (i.e., the end of fiscal 2013) and, subject to

the meeting of the performance target and satisfaction of continuing service requirements, would have been paid

following the last day of the second fiscal year following the end of the performance period (i.e., the end of fiscal

2015). We believed the combination of this performance metric and time-based vesting requirement provided

appropriate performance incentives and promoted the long-term retention of our executive officers. By basing the

FY13 LTIP payout on operating cash flow, the plan focused on a specific, measurable corporate goal that was

aligned with generating stockholder value, and provided performance-based compensation based upon the actual

achievement of the goal. We believed that the exclusive metric of operating cash flow, as opposed to revenue or

non-GAAP EPS, appropriately focused our executives on tangible growth and cost reduction opportunities.

Operating cash flow is also a direct measure of business success and balances the annual plan measures that are

not subject to some of the timing issues associated with the accounting rules relating to revenue and non-GAAP

EPS, which can lead to fluctuations in results that are not necessarily directly tied to our business success.

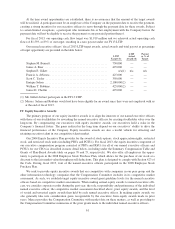

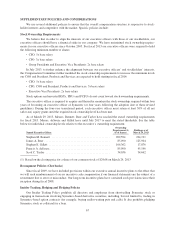

Participants received no payments under the FY13 LTIP since at least 85% of the budgeted operating cash

flow target was not achieved. A participant would be eligible for 25% of the target FY13 LTIP award if at least

85% of the budgeted operating cash flow target were achieved with respect to the performance period and for up

to 200% of the target FY13 LTIP award if at least 120% of budgeted operating cash flow was attained with

respect to the performance period. The following table presents the threshold, target and maximum performance

levels of the operating cash flow target as a percentage of the performance target and the relative payout at each

level as a percentage of the applicable target opportunity under the FY13 LTIP:

Cash Flow from Operations

Performance

as % of

Target

Payout as

%of

Target

Threshold ...................................................... 85 25

Target ........................................................ 100 100

Maximum ..................................................... 120 200

60