Symantec 2013 Annual Report Download - page 147

Download and view the complete annual report

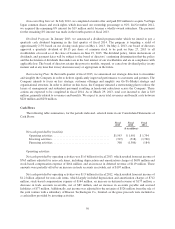

Please find page 147 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Notes: In the first quarter of fiscal 2013, we issued $600 million in principal amount of 2.75% senior

notes due June 2017 and $400 million in principal amount of 3.95% senior notes due June 2022, for an aggregate

principal amount of $1.0 billion. In the second quarter of fiscal 2011, we issued $350 million in principal amount

of 2.75% senior notes due September 2015 and $750 million in principal amount of 4.20% senior notes due

September 2020, for an aggregate principal amount of $1.1 billion.

Revolving Credit Facility: In the second quarter of fiscal 2011, we entered into a $1.0 billion senior

unsecured revolving credit facility (“credit facility”), which was amended in the first quarter of 2013 to extend

the term to June 2017. Under the terms of this credit facility, we must comply with certain financial and non-

financial covenants, including a debt to EBITDA (earnings before interest, taxes, depreciation and amortization)

covenant. As of March 29, 2013, we were in compliance with all required covenants, and there was no

outstanding balance on the credit facility.

We believe that our existing cash and investment balances, our borrowing capacity, our ability to issue new

debt instruments, and cash generated from operations will be sufficient to meet our working capital, capital

expenditure requirements, and payments of principal and interest on debt, as well as any cash dividends to be

paid under the capital allocation program announced in January 2013 and repurchases of our stock, for the next

12 months and foreseeable future. We are in the process of implementing a capital allocation strategy pursuant to

which we expect to return over time approximately 50% of free cash flow to stockholders through a combination

of dividends and share repurchases, while still enabling our company to invest in its future. Our strategy will

emphasize organic growth through internal innovation and will be complemented by acquisitions that fit

strategically and meet specific internal profitability hurdles.

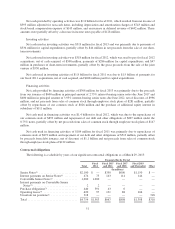

Uses of Cash

Our principal cash requirements include working capital, capital expenditures, payments of principal and

interest on our debt, and payments of taxes. Also, we may, from time to time, engage in the open market

purchase of our convertible notes prior to their maturity. In January 2013, the Company announced a capital

allocation program, which includes plans to initiate a quarterly cash dividend. In addition, we regularly evaluate

our ability to repurchase stock, pay debts, and acquire other businesses.

Acquisitions: In fiscal 2013, we acquired a privately-held provider of mobile application management for an

aggregate payment of $28 million, net of cash acquired. In fiscal 2012, we acquired Clearwell, LiveOffice, and

another company for an aggregate amount of $508 million, net of cash acquired. In fiscal 2011, we acquired the

identity and authentication business of VeriSign, as well as PGP, GuardianEdge, and two other companies for an

aggregate amount of $1.5 billion, net of cash acquired.

Convertible Senior Notes: In June 2006, we issued $1.1 billion principal amount of 0.75% notes due June

2011, and $1.0 billion principal amount of 1.00% notes due June 2013, to initial purchasers in a private offering

for resale to qualified institutional buyers pursuant to SEC Rule 144A. In fiscal 2011, we repurchased $500

million of aggregate principal amount of our 0.75% notes in privately negotiated transactions for approximately

$510 million. Concurrently with the repurchase, we sold a proportionate share of the note hedges that we entered

into at the time of the issuance of the convertible notes back to the note hedge counterparties for approximately

$13 million. The net cost of the repurchase of the 0.75% notes and the concurrent sale of the note hedges was

$497 million in cash. We repaid the $600 million balance under our 0.75% notes upon maturity in fiscal 2012.

We intend to use $1.0 billion of our cash and cash equivalents to repay our 1.00% notes that mature in June 2013.

Stock Repurchases: We repurchased 49 million, 51 million, and 57 million shares for $826 million, $893

million, and $870 million during fiscal 2013, 2012, and 2011, respectively. As of March 29, 2013, we had $1.2

billion remaining under the plans authorized for future repurchases. This includes a new $1.0 billion stock

repurchase program authorized by our board of directors during the fourth quarter of fiscal 2013. The new

program will commence in fiscal 2014.

49