Symantec 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue concerning compensating adjustments arising from this matter, resulting in an additional $10 million

tax benefit in the fourth quarter of fiscal 2011. This matter has now been closed and no further adjustments to the

accrued liability are expected.

On December 2, 2009, we received a Revenue Agent’s Report from the IRS for the VERITAS 2002 through

2005 tax years assessing additional taxes due. We contested $80 million of the tax assessed and all penalties. As

a result of negotiations with IRS Appeals in the third quarter of fiscal 2012, we remeasured our liability for

unrecognized tax benefits, resulting in a tax benefit of $52 million. We executed the final closing agreement for

the VERITAS 2002 through 2005 tax years on December 26, 2012. Accordingly, we recorded a further tax

benefit of $3 million during the third quarter of fiscal 2013 based on the closing agreement. Further, we amended

our state tax returns for the VERITAS 2002 through 2005 tax years in the fourth quarter of fiscal 2013 to reflect

the adjustments in the closing agreement and remeasured our state liability resulting in a benefit of $7 million.

The timing of the resolution of income tax examinations is highly uncertain, and the amounts ultimately

paid, if any, upon resolution of the issues raised by the taxing authorities may differ materially from the amounts

accrued for each year. Although potential resolution of uncertain tax positions involve multiple tax periods and

jurisdictions, it is reasonably possible that the gross unrecognized tax benefits related to these audits could

decrease (whether by payment, release, or a combination of both) in the next 12 months by between $15 million

and $130 million. Depending on the nature of the settlement or expiration of statutes of limitations, we estimate

at least $15 million could affect our income tax provision and therefore benefit the resulting effective tax rate. As

of March 29, 2013, we have $76 million on deposit with the IRS pertaining to U.S. tax matters in the Symantec

2005 through 2008 audit cycle.

We continue to monitor the progress of ongoing tax controversies and the impact, if any, of the expected

tolling of the statute of limitations in various taxing jurisdictions.

Noncontrolling interest

In fiscal 2011, we completed the acquisition of the identity and authentication business of VeriSign,

including a controlling interest in its subsidiary VeriSign Japan K.K. (“VeriSign Japan”), a publicly traded

company on the Tokyo Stock Exchange. Given our majority ownership interest of 54% in VeriSign Japan, the

accounts of VeriSign Japan have been consolidated with our accounts, and a noncontrolling interest has been

recorded for the noncontrolling investors’ interests in the equity and operations of VeriSign Japan. During the

second quarter of fiscal 2013, we completed a tender offer and paid $92 million to acquire VeriSign Japan

common shares and stock rights, which increased our ownership percentage to 92%. During the third quarter of

fiscal 2013, we acquired the remaining 8% interest for $19 million and VeriSign Japan became a wholly-owned

subsidiary. The payment was made in the fourth quarter of fiscal 2013. See Note 14 of the Notes to Consolidated

Financial Statements in this annual report for additional information. For fiscal 2013, 2012, and 2011, the loss

attributable to the noncontrolling interest in VeriSign Japan was approximately $0 million, $0 million, and

$4 million, respectively.

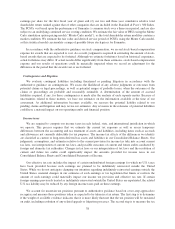

LIQUIDITY AND CAPITAL RESOURCES

Sources of cash

We have historically relied on cash flow from operations, borrowings under a credit facility, and issuances

of debt and equity securities for our liquidity needs. As of March 29, 2013, we had cash and cash equivalents of

$4.7 billion and an unused credit facility of $1.0 billion resulting in a liquidity position of $5.7 billion. As of

March 29, 2013, $2.6 billion in cash, cash equivalents, and marketable securities were held by our foreign

subsidiaries. We have provided U.S. deferred taxes on a portion of our undistributed foreign earnings sufficient

to address the incremental U.S. tax that would be due if we needed such portion of these funds to support our

operations in the U.S.

48