Shaw 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

(ii) During 2010, the Company purchased all of the outstanding shares of Mountain Cablevision

in Hamilton, Ontario. The cable system serves approximately 41,000 basic subscribers and

results of operations have been included commencing November 1, 2009.

(iii) During 2009, the Company purchased the assets comprising the Campbell River cable

system in British Columbia which serves approximately 12,000 basic subscribers. The

acquisition was effective February 1, 2009 and results of operations have been included

from that date.

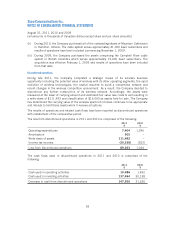

Discontinued operations

During late 2011, the Company completed a strategic review of its wireless business

opportunity including the potential value of wireless with its other operating segments, the rapid

evolution of wireless technologies, the capital required to build a competitive network and

recent changes in the wireless competitive environment. As a result, the Company decided to

discontinue any further construction of its wireless network. Accordingly, the assets were

measured at the lower of carrying amount and estimated fair value less costs to sell resulting in

a write-down of $111,492 and classification of $16,000 as assets held for sale. The Company

has determined the carrying value of the wireless spectrum licenses continues to be appropriate

and intends to hold these assets while it reviews all options.

The results of operations and related cash flows have been reported as discontinued operations

with restatement of the comparative period.

The loss from discontinued operations in 2011 and 2010 is comprised of the following:

2011

$

2010

$

Operating expenditures 7,404 1,396

Amortization 905 –

Write-down of assets 111,492 –

Income tax recovery (30,538) (352)

Loss from discontinued operations 89,263 1,044

The cash flows used in discontinued operations in 2011 and 2010 is comprised of the

following:

2011

$

2010

$

Cash used in operating activities 10,486 1,492

Cash used in investing activities 137,464 30,138

Decrease in cash from discontinued operations 147,950 31,630

93