Shaw 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

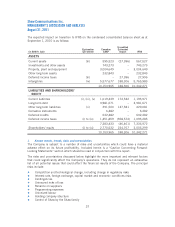

Carrying amount

2011 2010

$$

Broadcast rights and licenses

Cable systems 4,101,937 4,078,021

DTH and satellite services 983,132 983,132

Media 1,382,300 –

6,467,369 5,061,153

Goodwill

Non-regulated satellite services 88,111 88,111

Cable systems 85,332 81,032

Media 641,365 –

814,808 169,143

Wireless spectrum licenses 190,912 190,912

Net book value 7,473,089 5,421,208

viii) Employment benefit plans

Shaw has an unfunded defined benefit pension plan for key senior executives and various

funded defined benefit plans for certain unionized and non-unionized employees. The amounts

reported in the financial statements relating to the defined benefit pension plans are

determined using actuarial valuations that are based on several assumptions. The valuation

uses management’s assumptions for the discount rate, rate of compensation increase, the

expected return on plan assets (for funded plans) and expected average remaining years of

service of employees. While the Company believes these assumptions are reasonable,

differences in actual results or changes in assumptions could affect employee benefit

obligations and the related income statement impact. The Company accounts for differences

between actual and assumed results by recognizing differences in benefit obligations and plan

performance over the working lives of the employees who benefit from the plan. The most

significant assumption used to calculate the net employee benefit plan expense is the discount

rate. The discount rate is the interest rate used to determine the present value of the future

cash flows that is expected will be needed to settle employee benefit obligations. It is based on

the yield of long-term, high-quality corporate fixed income investments closely matching the

term of the estimated future cash flows and is determined at the end of every year. The

following table illustrates the increase on the accrued benefit obligation and pension expense of

a 1% decrease in the discount rate:

Accrued Benefit

Obligation at

End of Fiscal 2011

Pension Expense

Fiscal 2011

Discount Rate – Unfunded Plan 5.50% 5.75%

Weighted Average Discount Rate – Funded Plans 5.75% 5.65%

Impact of: 1% decrease ($000’s Cdn)- Unfunded Plan $56,297 $ 6,467

Impact of: 1% decrease ($000’s Cdn)- Funded Plans $20,212 $ 812

29