Shaw 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

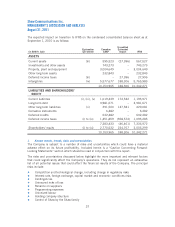

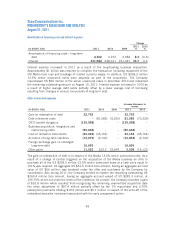

II. SUMMARY OF QUARTERLY RESULTS

(In $000’s

Cdn except

per share

amounts)

Quarter Revenue

Operating

income

before

amortization(1)

Net income

from

continuing

operations

attributable

to common

shareholders

Net income

attributable

to common

shareholders

Net

income(2)

Basic and

diluted

earnings

per share

from

continuing

operations

Basic

and

diluted

earnings

per share

2011

Fourth 1,180,699 476,229 164,458 80,709 82,488 0.37 0.18

Third 1,284,688 581,063 196,187 194,860 202,670 0.45 0.45

Second 1,196,611 499,400 165,101 161,490 167,299 0.38 0.37

First 1,078,905 474,136 17,218 16,642 20,332 0.04 0.04

Total 4,740,903 2,030,828 542,964 453,701 472,789 1.24 1.03

2010

Fourth 938,872 424,458 122,551 121,575 121,575 0.28 0.28

Third 943,632 435,912 158,284 158,216 158,216 0.37 0.37

Second 929,142 424,825 138,712 138,712 138,712 0.32 0.32

First 905,934 474,952 114,229 114,229 114,229 0.26 0.26

Total 3,717,580 1,760,147 533,776 532,732 532,732 1.23 1.23

(1) See key performance drivers on page 20.

(2) Net income attributable to both common shareholders and non-controlling interests.

Generally, revenue and operating income before amortization have grown quarter-over-quarter

mainly due to customer growth and rate increases with the exception of the second and fourth

quarters of 2010 and fourth quarter of 2011. In the fourth quarter of 2011, revenue and

operating income before amortization declined $104.0 million and $104.8 million,

respectively, due to the cyclical nature of the Media business with lower advertising revenues in

the summer months. In the fourth quarter of 2010, revenue and operating income before

amortization declined by $4.8 million and $11.5 million, respectively, due to customer growth

offset by timing of On-Demand events, increased promotional activity and timing of certain

expenses including maintenance and costs related to customer growth. Operating income before

amortization decreased by $50.1 million in the second quarter of 2010 due to the impact of

the one-time Part II fee recovery of $75.3 million recorded in the previous quarter.

Net income has fluctuated quarter-over-quarter primarily as a result of the growth in operating

income before amortization described above and the impact of the net change in non-operating

items. The first quarter of the current year was also impacted by the Media acquisition. As a

result, net income declined by $101.2 million in the first quarter of 2011 as the higher

operating income before amortization of $50.2 million due to the contribution from the new

Media division and lower income taxes of $32.1 million were offset by the CRTC benefit

obligation of $139.1 million and acquisition, integration and restructuring costs of $58.1

million. Net income increased $147.0 million in the second quarter of 2011 due to the impact

of the broadcasting business acquisition in the immediately preceding quarter and higher

operating income before amortization and foreign exchange gain on unhedged long-term debt,

44