Shaw 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

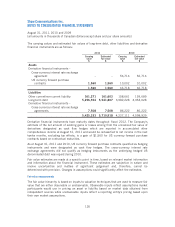

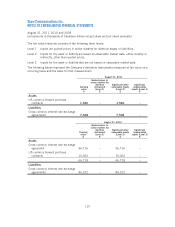

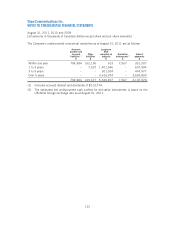

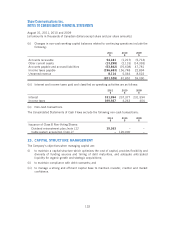

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

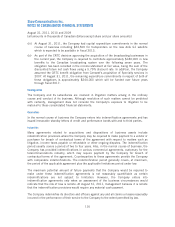

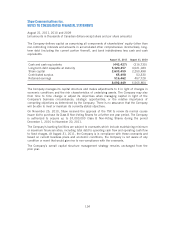

Burrard Landing Lot 2 Holdings Partnership

During the year, the Company paid $9,522 (2010 – $9,571; 2009 – $9,886) to the

Partnership for lease of office space in Shaw Tower. Shaw Tower, located in Vancouver, BC, is

the Company’s headquarters for its Lower Mainland operations.

Specialty Channels

As a result of the television broadcasting business acquisition in the current year (see note 2),

the Company acquired interests in a number of specialty television channels which are subject

to either joint control or significant influence. The Company paid network fees of $5,084 and

provided uplink of television signals of $923 to these channels during the period October 27,

2010 to August 31, 2011.

Other

The Company has entered into certain transactions with companies that are affiliated with

Directors of the Company as follows:

The Company paid $3,944 (2010 – $4,302; 2009 – $3,555) for direct sales agent, marketing,

installation and maintenance services to a company controlled by a Director of the Company.

During the year, the Company paid $5,683 (2010 – $6,162; 2009 – $6,094) for remote

control units to a supplier where Directors of the Company hold positions on the supplier’s

board of directors.

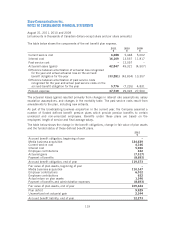

Other transactions

The Company has entered into certain transactions with Directors and senior officers of the

Company as follows:

Loans, interest and non-interest bearing, have in the past been granted to executive officers in

connection with their employment for periods ranging up to 10 years. The effective interest rate

on the interest bearing loan for 2011 was 1.0% (2010 – 1.0%; 2009 – 1.9%). The remaining

amount outstanding of $3,600 was repaid during 2011.

124