Shaw 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

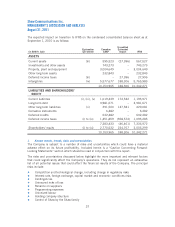

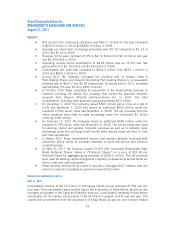

The expected impact on transition to IFRS on the condensed consolidated balance sheet as at

September 1, 2010 is as follows:

(in $000’s Cdn)

Explanation

(per above)

Canadian

GAAP

Unaudited

Estimated

Impact IFRS

ASSETS

Current assets (iii) 595,523 (27,996) 567,527

Investments and other assets 743,273 – 743,273

Property, plant and equipment 3,004,649 – 3,004,649

Other long-term assets 232,843 – 232,843

Deferred income taxes (iii) – 27,996 27,996

Intangibles (iv) 5,577,677 188,306 5,765,983

10,153,965 188,306 10,342,271

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities (i), (iii), (v) 1,019,439 174,532 1,193,971

Long-term debt 3,981,671 – 3,981,671

Other long-term liabilities (ii) 291,500 137,581 429,081

Derivative instruments 6,482 – 6,482

Deferred credits 632,482 – 632,482

Deferred income taxes (i) to (iv) 1,451,859 (358,574) 1,093,285

7,383,433 (46,461) 7,336,972

Shareholders’ equity (i) to (vi) 2,770,532 234,767 3,005,299

10,153,965 188,306 10,342,271

I. Known events, trends, risks and uncertainties

The Company is subject to a number of risks and uncertainties which could have a material

adverse effect on its future profitability. Included herein is a “Caution Concerning Forward-

Looking Statements” section which should be read in conjunction with this report.

The risks and uncertainties discussed below highlight the more important and relevant factors

that could significantly affect the Company’s operations. They do not represent an exhaustive

list of all potential issues that could affect the financial results of the Company. The principal

risks include:

ŠCompetition and technological change, including change in regulatory risks

ŠInterest rate, foreign exchange, capital market and economic conditions risks

ŠContingencies

ŠUninsured risks of loss

ŠReliance on suppliers

ŠProgramming expenses

ŠUnionized labour

ŠHolding company structure

ŠControl of Shaw by the Shaw family

37