Shaw 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

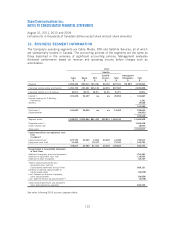

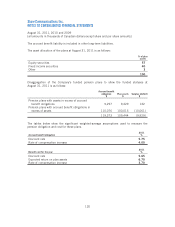

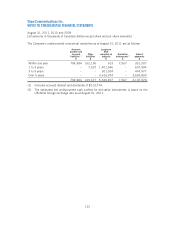

The table below shows the components of the post-retirement benefit plan expense.

2011

$

Current service cost 381

Interest cost 700

Actuarial loss 107

Plan amendment (430)

Difference between amortization of actuarial loss recognized for the year and actual

actuarial loss on the accrued benefit obligation for the year (107)

Difference between amortization of the plan amendment for the year and the actual

plan amendment on the accrued benefit obligation for the year 430

Post-retirement expense 1,081

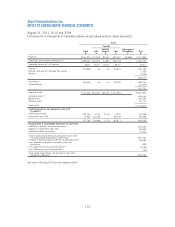

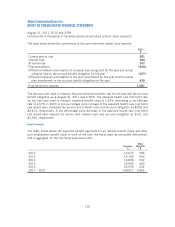

The discount rate used to measure the post-retirement benefit cost for the year and the accrued

benefit obligation as at August 31, 2011 was 5.50%. The assumed health care cost trend rate

for the next year used to measure expected benefit costs is 6.49% decreasing to an ultimate

rate of 4.57% in 2029. A one percentage point increase in the assumed health care cost trend

rate would have increased the service and interest costs and accrued obligation by $208 and

$2,414, respectively. A one percentage point decrease in the assumed health care cost trend

rate would have lowered the service and interest costs and accrued obligation by $161 and

$1,934, respectively.

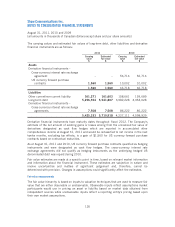

Benefit Payments

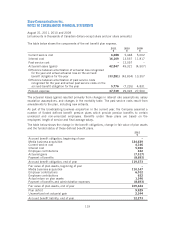

The table below shows the expected benefit payments for all defined benefit plans and other

post employment benefit plans in each of the next five fiscal years as actuarially determined,

and in aggregate, for the five fiscal years there after:

Pensions

$

Other

Benefits

$

2012 13,673 458

2013 14,185 493

2014 18,838 532

2015 26,940 580

2016 26,978 624

2017 – 2021 138,517 3,866

122