Shaw 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

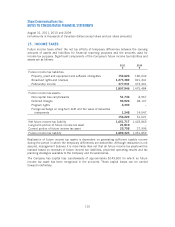

Preferred Shares

On May 31, 2011, the Company issued 12,000,000 Cumulative Redeemable Rate Reset

Preferred Shares, Series A (“Series A Preferred Shares”) at a price of $25.00 per Series A

Preferred Share for aggregate gross proceeds of $300,000. The Series A Preferred Shares

represent a series of Class 2 preferred shares and were offered by way of prospectus

supplement to the short form base shelf prospectus dated November 18, 2010.

Holders of the Series A Preferred Shares are entitled to receive, as and when declared by the

Company’s board of directors, a cumulative quarterly fixed dividend yielding 4.50% annually for

the initial period ending June 30, 2016. Thereafter, the dividend rate will be reset every five

years at a rate equal to the then current 5-year Government of Canada bond yield plus 2.00%.

Holders of Series A Preferred Shares will have the right, at their option, to convert their shares

into Cumulative Redeemable Floating Rate Preferred Shares, Series B (the “Series B Preferred

Shares”), subject to certain conditions, on June 30, 2016 and on June 30 every five years

thereafter. The Series B Preferred Shares also represent a series of Class 2 preferred shares and

holders will be entitled to receive cumulative quarterly dividends, as and when declared by the

Company’s board of directors, at a rate set quarterly equal to the then current three-month

Government of Canada Treasury Bill yield plus 2.00%.

Series A Preferred Shares are classified as equity since redemption, at $25.00 per Series A

Preferred Share, is at the Company’s option and payment of dividends is at the Company’s

discretion.

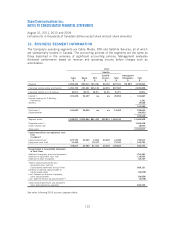

Stock option plan

Under a stock option plan, directors, officers, employees and consultants of the Company are

eligible to receive stock options to acquire Class B Non-Voting Shares with terms not to exceed

ten years from the date of grant. Options granted up to August 31, 2011 vest evenly on the

anniversary dates from the original grant date at either 25% per year over four years or 20% per

year over five years. The options must be issued at not less than the fair market value of the

Class B Non-Voting Shares at the date of grant. The maximum number of Class B Non-Voting

Shares issuable under the plan may not exceed 52,000,000. As at August 31, 2011,

16,794,703 Class B Non-Voting Shares have been issued under the plan.

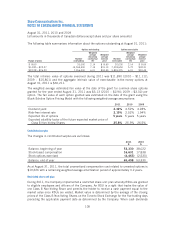

The changes in options are as follows:

2011 2010 2009

Number

Weighted

average

exercise

price

$ Number

Weighted

average

exercise

price

$ Number

Weighted

average

exercise

price

$

Outstanding, beginning of year 23,993,150 20.48 23,714,667 20.21 23,963,771 19.77

Granted 3,269,000 20.91 3,965,000 19.30 4,373,000 19.62

Forfeited (2,601,632) 20.88 (823,548) 20.80 (1,133,974) 20.67

Exercised (2,690,118) 17.08 (2,862,969) 16.51 (3,488,130) 16.34

Outstanding, end of year 21,970,400 20.91 23,993,150 20.48 23,714,667 20.21

104