Shaw 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

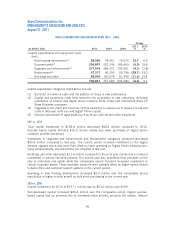

growth, partially offset by higher programming costs and increased sales and marketing.

Employee related costs were up on a full year basis, although benefitting from the restructuring

initiatives completed earlier this year. The current period also included the impact of the

retroactive support structure rate increases and the prior year benefitted from a one-time CRTC

Part II fee recovery of $75.3 million.

Shaw completed its review of the wireless strategic initiative and concluded that the economics

as a new entrant would be extremely challenging, even with the Company’s established base

and considerable strengths and assets. Shaw decided not to pursue a conventional wireless

build and instead intends to focus on initiatives that align with leveraging its Media and

programming assets and strengthening its leadership position in broadband and video. The

Company currently intends to hold its wireless spectrum while it reviews all options.

2010 vs. 2009

Consolidated revenue of $3.72 billion in 2010 improved 9.6% over 2009. The improvement

was primarily due to customer growth, including from acquisitions, and rate increases.

Consolidated operating income before amortization was up 14.3% over the comparable period

to $1.76 billion. The improvement was due to the revenue related growth, partially offset by

higher employee related and other costs associated with the increased subscriber base

including marketing and sales activities, as well as the impact of the new LPIF fees. The 2010

annual period also benefitted from a one-time CRTC Part II fee recovery. Excluding this

one-time recovery, the improvement was 9.4%.

Subscriber growth continued in 2010. Digital customers were up almost 330,000 subscribers

increasing digital penetration of Basic to over 70%, up from 57% at August 31, 2009. A

significant milestone was also reached in 2010 as the Company surpassed 1,000,000 Digital

Phone lines.

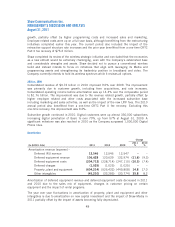

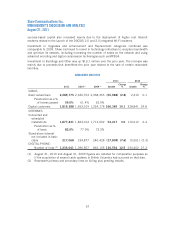

Amortization

Change

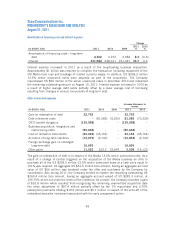

(In $000’s Cdn) 2011 2010 2009

2011

%

2010

%

Amortization revenue (expense) –

Deferred IRU revenue 12,546 12,546 12,547 ––

Deferred equipment revenue 106,628 120,639 132,974 (11.6) (9.3)

Deferred equipment costs (204,712) (228,714) (247,110) (10.5) (7.4)

Deferred charges (1,025) (1,025) (1,025) ––

Property, plant and equipment (604,214) (526,432) (449,808) 14.8 17.0

Other intangibles (45,210) (33,285) (30,774) 35.8 8.2

Amortization of deferred equipment revenue and deferred equipment costs decreased in 2011

and 2010 due to the sales mix of equipment, changes in customer pricing on certain

equipment and the impact of rental programs.

The year over year fluctuations in amortization of property, plant and equipment and other

intangibles is due to amortization on new capital investment and the impact of Shaw Media in

2011 partially offset by the impact of assets becoming fully depreciated.

48