Shaw 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

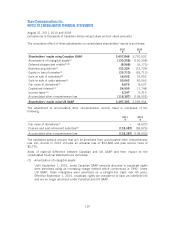

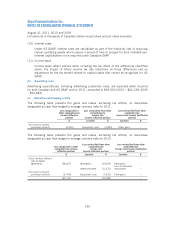

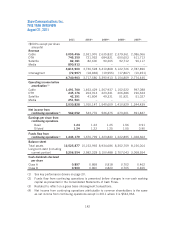

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

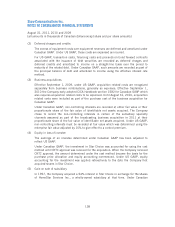

GAAP, the acquisition of the investment in Star Choice was a non-monetary transaction

that did not result in the culmination of the earnings process, as it was an exchange of

control over similar productive assets. As a result, the carrying value of the Star Choice

investment was recorded at the book value of assets provided as consideration on the

transaction. Under US GAAP, the transaction would have been recorded at the fair value

of the shares in HomeStar Services Inc. This would have resulted in a gain on disposition

of the consideration the Company exchanged for its investment in Star Choice and an

increase in the acquisition cost for Star Choice.

(6) Gain on sale of cable systems

The gain on sale of cable systems determined under Canadian GAAP has been adjusted to

reflect the lower net book value of broadcast rights under US GAAP as a result of item

(1) adjustments.

Under Canadian GAAP, no gain was recorded in 1995 on an exchange of cable systems

with Rogers Communications Inc. on the basis that this was an exchange of similar

productive assets. Under US GAAP the gain net of applicable taxes is recorded and

amortization adjusted as a result of the increase in broadcast rights upon the recognition

of the gain.

(7) Fair value of derivatives

Certain derivatives that qualify for cash flow hedge accounting under Canadian GAAP do

not qualify for similar treatment for US GAAP.

(8) Subscriber connection fee revenue

Subscriber connection fee revenue is deferred and amortized under Canadian GAAP.

Under US GAAP, connection revenues are recognized immediately to the extent of related

costs, with any excess deferred and amortized.

(9) Employee benefit plans

Under US GAAP, the Company is required to recognize the funded status of defined

benefit pension and other post-retirement plans on the Consolidated Balance Sheet and to

recognize changes in the funded status in other comprehensive income (loss).

Under Canadian GAAP, the over or under funded status of such plans is not recognized on

the Consolidated Balance Sheet.

139