Shaw 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

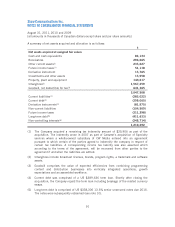

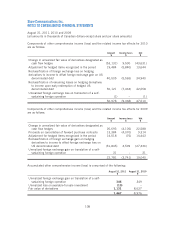

Corporate

Bank loans

The Company has a $50,000 revolving operating loan facility, of which $654 has been drawn

as committed letters of credit. Interest rates and borrowing options are principally the same as

those contained in the credit facility described below. The effective interest rate on the facility

for 2011 was 2.99% (2010 – 2.34%; 2009 – 3.09%).

A syndicate of banks has provided the Company with an unsecured $1 billion credit facility due

in May 2012. Funds are available to the Company in both Canadian and US dollars. Interest

rates fluctuate with Canadian bankers’ acceptance rates, US bank base rates and LIBOR rates.

The effective interest rate on actual borrowings during 2011 was 2.59% (2009 – 3.06%). No

amounts we drawn under the facility during 2010.

Senior notes

The senior notes are unsecured obligations and rank equally and ratably with all existing and

future senior indebtedness. The notes are redeemable at the Company’s option at any time, in

whole or in part, prior to maturity at 100% of the principal amount plus a make-whole

premium.

On each of December 7, 2010 and February 17, 2011, the Company issued an additional

$400,000 under the reopened 6.75% senior unsecured notes due 2039. The effective interest

rate on the aggregate $1,450,000 senior notes is 6.89% due to discounts on the issuances.

On December 7, 2010, the Company issued $500,000 senior notes at a rate of 5.50% due

December 7, 2020. The effective rate is 5.55% due to the discount on the issuance.

Other

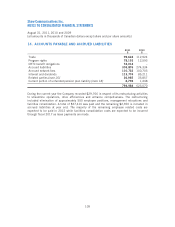

Burrard Landing Lot 2 Holdings Partnership

The Company has a 33.33% interest in the Partnership which built the Shaw Tower project

with office/retail space and living/working space in Vancouver, BC. In the fall of 2004, the

commercial construction of the building was completed and at that time, the Partnership issued

10 year secured mortgage bonds in respect of the commercial component of the Shaw Tower.

The bonds bear interest at 6.31% compounded semi-annually and are collateralized by the

property and the commercial rental income from the building with no recourse to the Company.

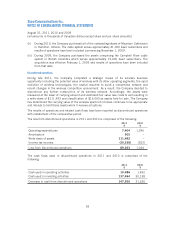

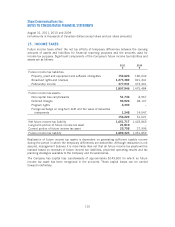

Gain on redemption of debt

The Company assumed US $338,306 senior unsecured notes on acquisition of the Canwest

broadcasting businesses. The US $312,000 13.5% senior unsecured notes were originally

issued on July 3, 2008. For periods up to August 15, 2011, interest was accrued, however was

not payable until maturity unless CW Media elected to do so. As at acquisition date, US

$26,306 of accrued interest remained outstanding and was included in the principal debt

balance with respect to the period July 3, 2008 to February 15, 2009. Interest for all periods

subsequent to February 15, 2009 was paid in cash.

100