Shaw 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

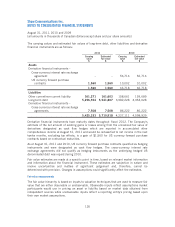

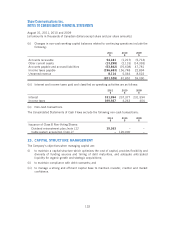

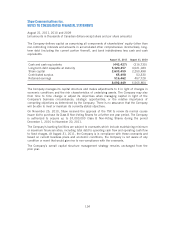

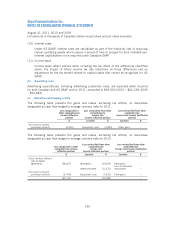

(ii) Changes in non-cash working capital balances related to continuing operations include the

following:

2011 2010 2009

$$$

Accounts receivable 54,181 (1,217) (5,714)

Other current assets (13,298) (2,115) (14,393)

Accounts payable and accrued liabilities (53,842) (76,608) 47,781

Income taxes payable (196,683) 156,748 22,894

Unearned revenue 8,114 5,044 8,522

(201,528) 81,852 59,090

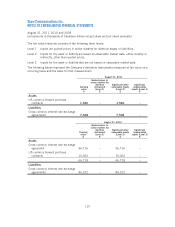

(iii) Interest and income taxes paid and classified as operating activities are as follows:

2011 2010 2009

$$$

Interest 331,994 237,377 231,594

Income taxes 399,927 4,243 404

(iv) Non-cash transactions

The Consolidated Statements of Cash Flows exclude the following non-cash transactions:

2011 2010 2009

$$$

Issuance of Class B Non-Voting Shares:

Dividend reinvestment plan [note 12] 39,363 ––

Cable system acquisition [note 2] –120,000 –

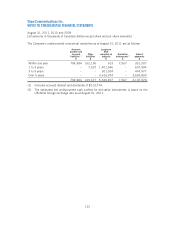

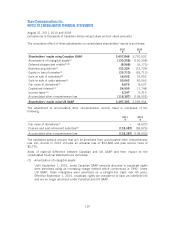

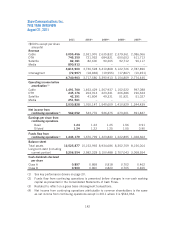

23. CAPITAL STRUCTURE MANAGEMENT

The Company’s objectives when managing capital are:

(i) to maintain a capital structure which optimizes the cost of capital, provides flexibility and

diversity of funding sources and timing of debt maturities, and adequate anticipated

liquidity for organic growth and strategic acquisitions;

(ii) to maintain compliance with debt covenants; and

(iii) to manage a strong and efficient capital base to maintain investor, creditor and market

confidence.

133