Shaw 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shaw Communications Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

August 31, 2011, 2010 and 2009

[all amounts in thousands of Canadian dollars except share and per share amounts]

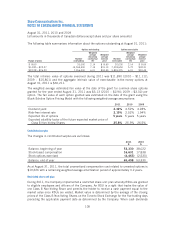

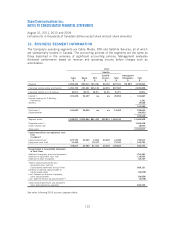

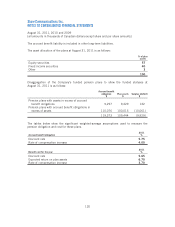

15. INCOME TAXES

Future income taxes reflect the net tax effects of temporary differences between the carrying

amounts of assets and liabilities for financial reporting purposes and the amounts used for

income tax purposes. Significant components of the Company’s future income tax liabilities and

assets are as follows:

2011 2010

$$

Future income tax liabilities:

Property, plant and equipment and software intangibles 154,626 180,642

Broadcast rights and licenses 1,275,389 921,441

Partnership income 377,931 373,401

1,807,946 1,475,484

Future income tax assets:

Non-capital loss carryforwards 51,746 8,967

Deferred charges 96,926 28,107

Program rights 6,309 –

Foreign exchange on long-term debt and fair value of derivative

instruments 1,248 14,547

156,229 51,621

Net future income tax liability 1,651,717 1,423,863

Long-term portion of future income tax asset 21,810 –

Current portion of future income tax asset 25,798 27,996

Future income tax liability 1,699,325 1,451,859

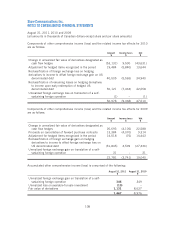

Realization of future income tax assets is dependent on generating sufficient taxable income

during the period in which the temporary differences are deductible. Although realization is not

assured, management believes it is more likely than not that all future income tax assets will be

realized based on reversals of future income tax liabilities, projected operating results and tax

planning strategies available to the Company and its subsidiaries.

The Company has capital loss carryforwards of approximately $149,600 for which no future

income tax asset has been recognized in the accounts. These capital losses can be carried

forward indefinitely.

110