Shaw 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Shaw annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shaw Communications Inc.

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 31, 2011

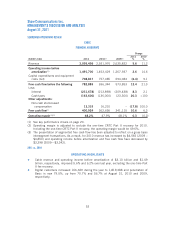

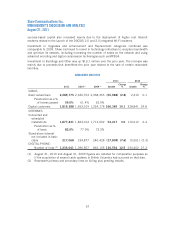

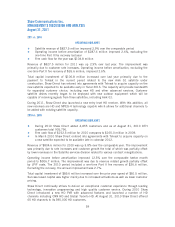

Current assets increased $666.8 million primarily due to increases in cash and cash

equivalents of $226.7 million, accounts receivable of $246.4 million, inventories of $43.1

million, other current assets of $202.9 million and assets held for sale of $15 million, all of

which were partially offset by a decrease in derivative instruments of $65.2 million. Cash and

cash equivalents increased as the net funds provided by operating and financing activities,

including proceeds from the issuance of $1.3 billion of senior notes and $300.0 million

Preferred Shares, exceeded the cash outlays on capital expenditures and the broadcasting

business acquisition and the cash requirements of the wireless build prior to being

discontinued. Accounts receivable and other current assets were up primarily as a result of the

Media acquisition while inventories were higher due to increased equipment purchases. Assets

held for sale of $15 million arose due to the decision to cease further construction of a wireless

network. Derivative instruments decreased due to settlement of the contracts.

Investments and other assets decreased $730 million due to the acquisition of remaining

equity interest in CW Media which is now consolidated as a 100% owned subsidiary and

expensing of acquisition related costs partially offset by investments in several specialty

channels purchased in the Media acquisition.

Property, plant and equipment and other intangibles increased $195.6 million and $72.8

million, respectively as current year capital investment and amounts acquired on the Media

acquisition exceeded amortization and the impact of the Company’s decision to cease further

construction of its wireless network which resulted in a write-down of $111.5 million and

reclassification of $16 million to assets held for sale.

Future income taxes of $21.8 million arose due to timing of temporary differences.

Other long-term assets increased $24.9 million primarily due to higher deferred equipment

costs and prepaid maintenance and support contracts.

Broadcast rights and licenses, and goodwill increased $1.4 billion and $645.7 million,

respectively, primarily due to the Media acquisition. Program rights of $67.1 million also arose

due to the acquisition.

Current liabilities were up $111.8 million due to increases in accounts payable of $171.9

million, other liability of $161.3 million and unearned revenue of $9.1 million partially offset

by decreases in income taxes payable of $158.2 million and derivative instruments of $72.2

million. Accounts payable and accrued liabilities increased primarily due to the impact of the

Media acquisition. Unearned revenue increased due to rate increases and customer growth.

Income taxes payable decreased due to funding income tax amounts partially offset by current

year tax expense and amounts assumed on the Media acquisition. Derivative instruments

decreased due to the end of swap notional exchange relating to an outstanding cross-currency

interest rate agreement partially offset by reclassifying amounts from non-current liabilities

based on settlement dates. The other liability is the obligation in respect of the principal

component of the US $300 million amended cross-currency interest rate agreements which has

been reclassified from noncurrent liabilities as it settles in December 2011.

Long-term debt increased $1.3 billion as a result of the issuance of $900 million senior notes

in December 2010 and $400 million in February 2011. Approximately $1 billion was required

to complete the Media acquisition during the first quarter. The acquisition was initially funded

through borrowings under the Company’s revolving credit facility which were subsequently

repaid primarily with the net proceeds from the $900 million senior notes offerings.

62